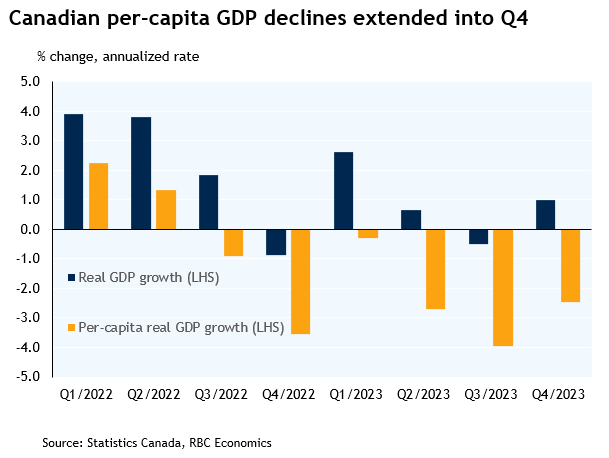

Canadian GDP per capita declined for the 6th consecutive quarter in the final quarter of 2023; this means there are less resources per person–the standard of living is in decline. A new RBC study finds that more than half – one million – of 1.9 million new Canadian households by 2030 will not be able to buy a home if affordability remains close to where it is today. Worst, more than 40% of the new households that can’t buy a home will also not earn enough to afford rent at the market price.

A new RBC study finds that more than half – one million – of 1.9 million new Canadian households by 2030 will not be able to buy a home if affordability remains close to where it is today. Worst, more than 40% of the new households that can’t buy a home will also not earn enough to afford rent at the market price.

This is not because Canadian incomes are low relative to other nations, it’s because home prices and rents have been allowed to gallop ahead thanks to monetary and fiscal policies aimed at price inflation.

The video below offers a worthwhile overview of the similarities between the Canadian and Australia economies and how the necessary phasing out of fossil fuels will require signficant capital investment and new fiscal and monetary policies for both. We must tax what we want less of and enable what we need more.

Australia 🇦🇺 and Canada 🇨🇦, even though they’re far apart, actually have a lot in common when it comes to their economies. They both rely a lot on selling commodities like minerals and oil, which can be risky. Also, both countries deal with challenges in their housing markets because of immigration 🏠, which drives up prices in big cities. Plus, they’re both trying to figure out how to boost innovation and productivity 🚀. Australia has seen some success with economic reforms that helped its economy grow, while Canada is still figuring out how to deal with its heavy dependence on oil and gas exports ⛽️. In a world full of uncertainty, both nations are working hard to make the most of their economic strengths while tackling their weaknesses. Here is a direct video link.