A wave of new multifamily residential projects are coming online as migration slows and high mortgage rates weigh on housing demand. Add to the mix an insurance crisis, and a seller’s market is becoming a buyer’s one. See, In Southwest Florida, high home insurance rates are driving away would-be buyers:

Florida’s southwestern coast — long one of America’s fastest-growing regions — is losing some of its boomtown swagger as a home-insurance crisis and other soaring costs make homes unaffordable.

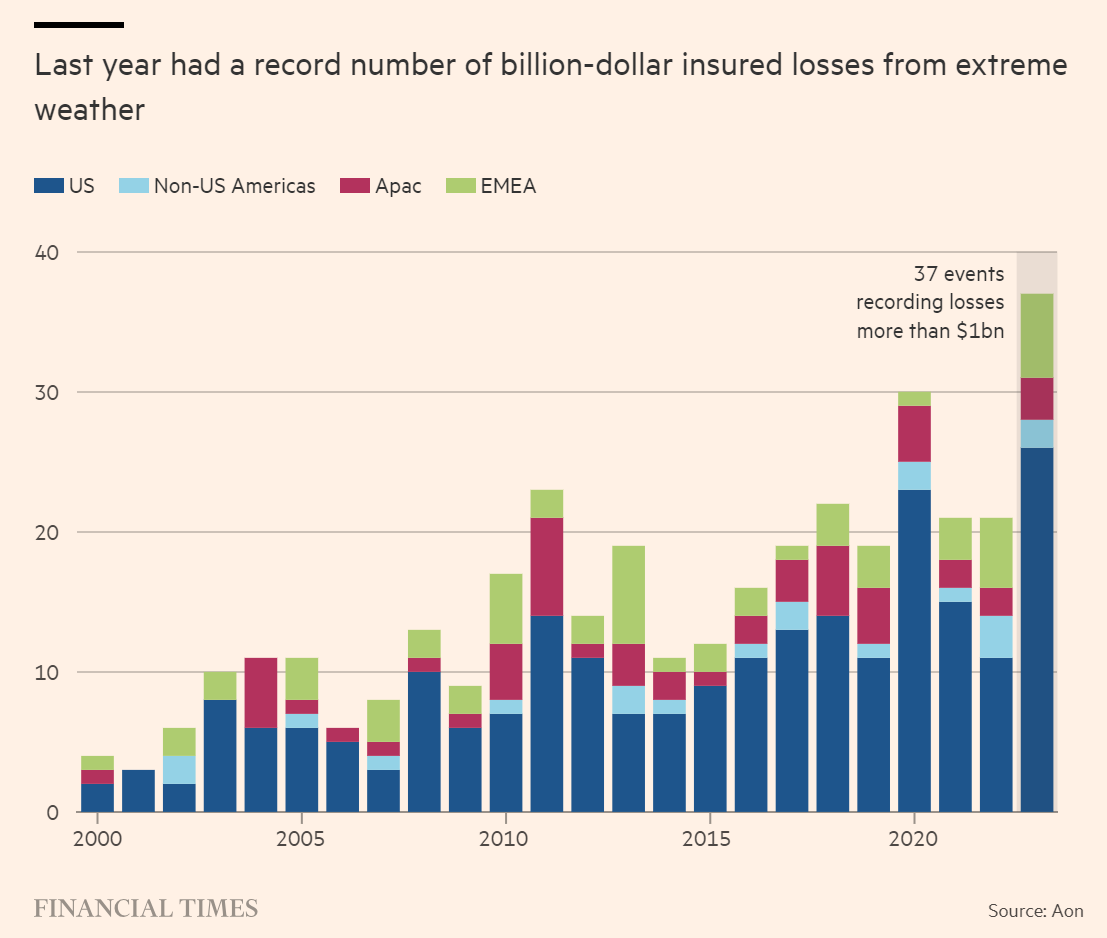

Homeowners from Sarasota south to Naples, known for its eight-figure waterfront mansions, are having a tougher time selling their properties, and the buildup in inventory has caused home prices to fall at some of the fastest rates in the nation. Realtors point to rising insurance costs that were exacerbated by Hurricane Ian in 2022, prompting some homeowners to list their homes for sale and would-be buyers to walk.