Rising unemployment has overtaken inflation as the dominant fear, and today is expected to bring the Fed’s first rate cut of a new easing cycle.

Like Pavlovian dogs, stocks typically rally in anticipation of Fed easing. However, unemployment continued to surge in the eight recessions since 1969, and stock markets eventually fell an average of 24% in the 195 days after the first Fed cut.

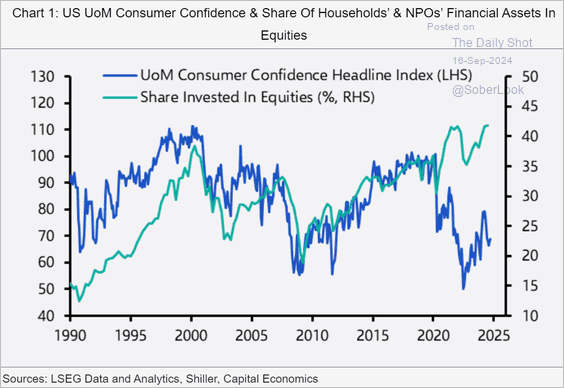

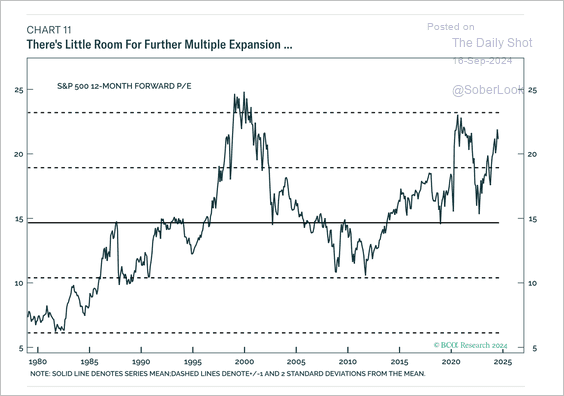

In the three rare incidents where stocks entered cutting cycles at extreme valuation highs, similar to now (1973, 2000 and 2007), the S&P 500 lost 35 to 56%. The masses holding little cash and bonds with record equity allocations are set up to suffer.

Anna Wong, Chief U.S. Economist of Bloomberg Economics, discusses the health of the U.S. labor market, the chance of a recession “steepening”, and the election’s impact on economic growth. Here is a direct video link.