Danielle was a guest with Jim Goddard on Talk Digital Network, talking about recent developments in the world economy and markets. You can listen to an audio clip of the segment here.

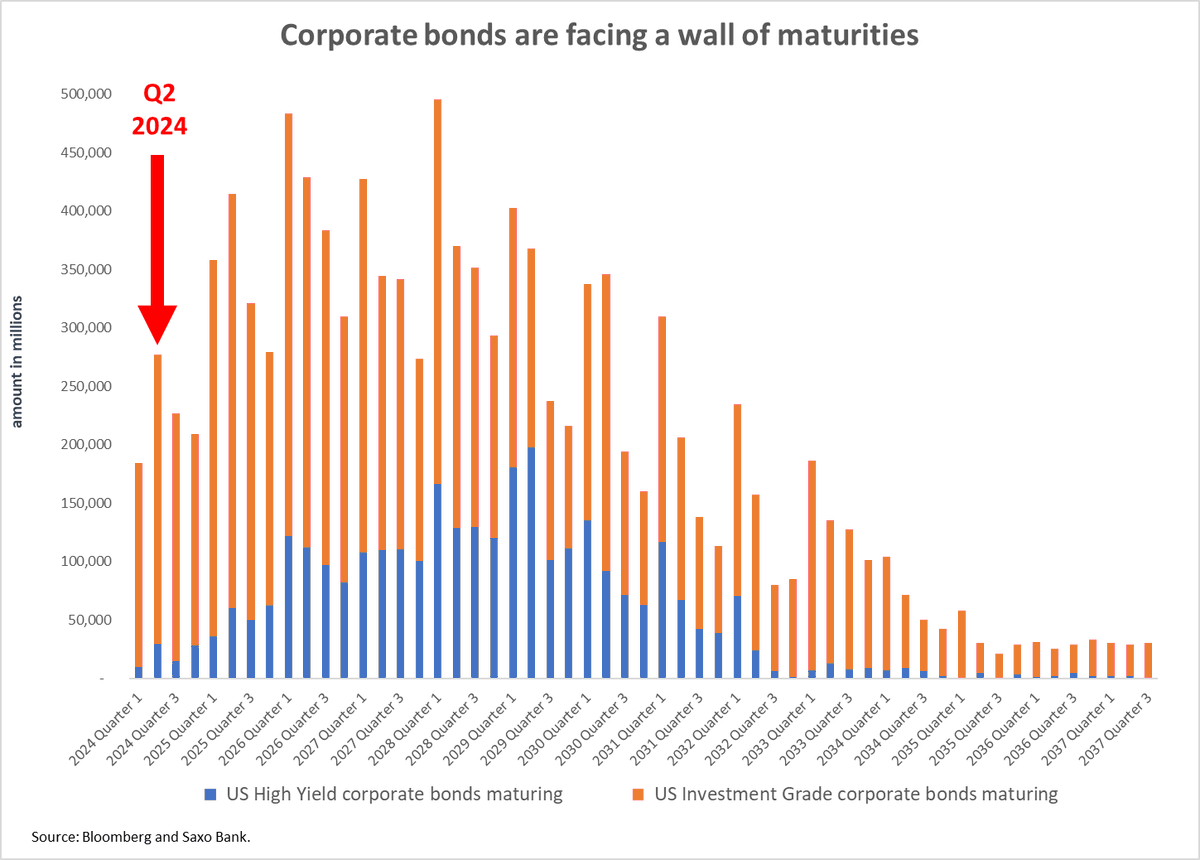

The chart below shows the bulge of US corporate debt (investment grade in orange and junk quality in blue) coming up for maturity quarterly through 2032.

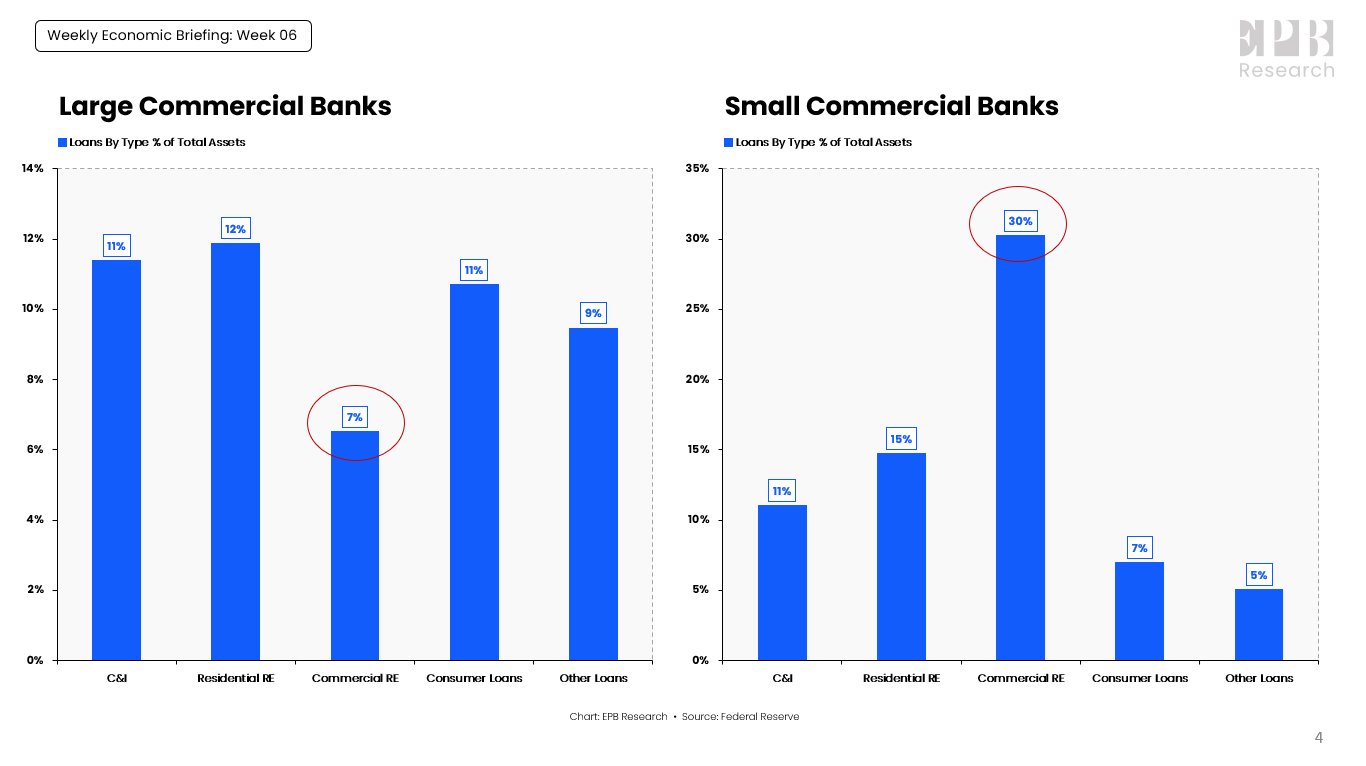

Commercial real estate loans account for 30% of assets at small banks, compared with just 7% at bigger lenders (chart courtesy of EPB Macro below).

Commercial real estate loans account for 30% of assets at small banks, compared with just 7% at bigger lenders (chart courtesy of EPB Macro below).  These issues are not contained in North America. See, German bank braces for wave of bad loans in ‘greatest real estate crisis since the financial crisis’:

These issues are not contained in North America. See, German bank braces for wave of bad loans in ‘greatest real estate crisis since the financial crisis’:

Shares of PBB, the second German bank to warn of mounting losses on commercial real estate in two weeks, have slumped 17% since Friday. The stock has tumbled more than 25% so far this year and 40% in the past six months.

Germany’s biggest lender Deutsche Bank said last week that it had allocated €123 million ($133 million) during the fourth quarter of last year to absorb potential defaults on its US commercial real estate loans. That’s more than quadruple the amount it set aside during the same three-month period in 2022.

The Aozora Bank headquarters in Tokyo Japan, on February 1, 2024. The bank’s shares fell over 21% after it said it had made losses on loans tied to US commercial real estate.Banks as far apart as New York, Tokyo and Zurich have also reported mounting losses on lending to the troubled commercial property sector in recent days.

On Wednesday, New York Community Bancorp attempted to reassure investors that it has enough cash to stay afloat after the stock shed about 60% of its value over the past eight days and ratings agency Moody’s downgraded the bank’s credit grade to junk.

Last week, the troubled US regional lender reported a surprise $252 million loss for the fourth quarter, a big chunk of which was tied to loans for office buildings. It also set aside $552 million in the quarter to absorb potential losses on loans, up sharply from $62 million in the previous quarter.

Also last week, Japan’s Aozora Bank said bad loans tied to US offices were partly to blame for its projected annual loss of 28 billion yen ($190 million) last year. And Swiss private bank and wealth manager Julius Baer said profit slumped 55% in 2023 because it lost 586 million Swiss francs ($680 million) on loans made to a single “European conglomerate,” reportedly the failed Austrian developer Signa Group.