Fine wine prices have tumbled back to the pandemic lows of 2020 due to falling consumption, globally.

Fine wine prices are decreasing sharply amid rising inventories and low demand for some of the most expensive wine #MacroEdge pic.twitter.com/qzuVSh3ixd

— MacroEdge (@MacroEdgeRes) September 3, 2024

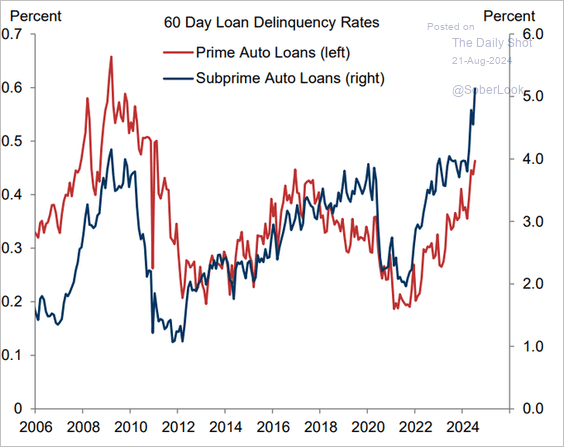

Are consumers struggling financially or realizing that alcohol is toxic for their brains?

At the same time, slumping demand for luxury goods is causing Swiss watchmakers to seek state aid:

Swiss watchmakers are suffering from a sharp decline in demand, especially in China, following an unprecedented boom during the post-pandemic era when consumers rushed to buy pricey timepieces. After three straight years of record exports, wholesale watch exports have fallen by 2.4% in value in the first seven months of the year as consumers refrain from splashing out on expensive watches.

The drop in consumer demand has hit brands making slightly less expensive watches the hardest, while top-selling brands such as Rolex and Patek Philippe have been more resilient.

The slowdown has also affected Richemont, the group behind Vacheron Constantin and IWC, and Omega owner Swatch Group AG, which have both seen sales dive in China.

The earnings of art dealers are sporting similar trends, see Sotheby’s earnings plunge as art market catches a chill:

Sotheby’s has reported an 88 percent plunge in its core earnings and a 25 percent decline in auction sales, as a chill in the art market hits one of the industry’s most famous brokers.

The first-half figures at Sotheby’s main auction business reveal the extent of the financial pressure the group came under before it struck an investment deal with Abu Dhabi this month.

Weaker luxury spending in China is among the factors weighing on demand for fine art and affecting both Sotheby’s and historic rival Christie’s.

This morning, the US 2-year Treasury yield fell to 3.796%, the lowest level since May 2023. In the process, the US 2 and 10-year yield curve (below since 2019) turned briefly positive (short yield lower than long) after a record 796 days of inversion (2-year yielding more than the 10-year) since July 8, 2022.

The July 2024-Sept 2024 curve inversion is now the longest since 1927/29 and exceeds other record inversion periods that preceded the brutal 1973/74 and 2007/08 recessions and bear markets. It was when the curve finally un-inverted that all hell broke loose.

There are some important warnings here for those able and prepared to see. Sadly, most financial ‘experts’ are paid to look the other way and keep customers long-always the riskiest investment products.