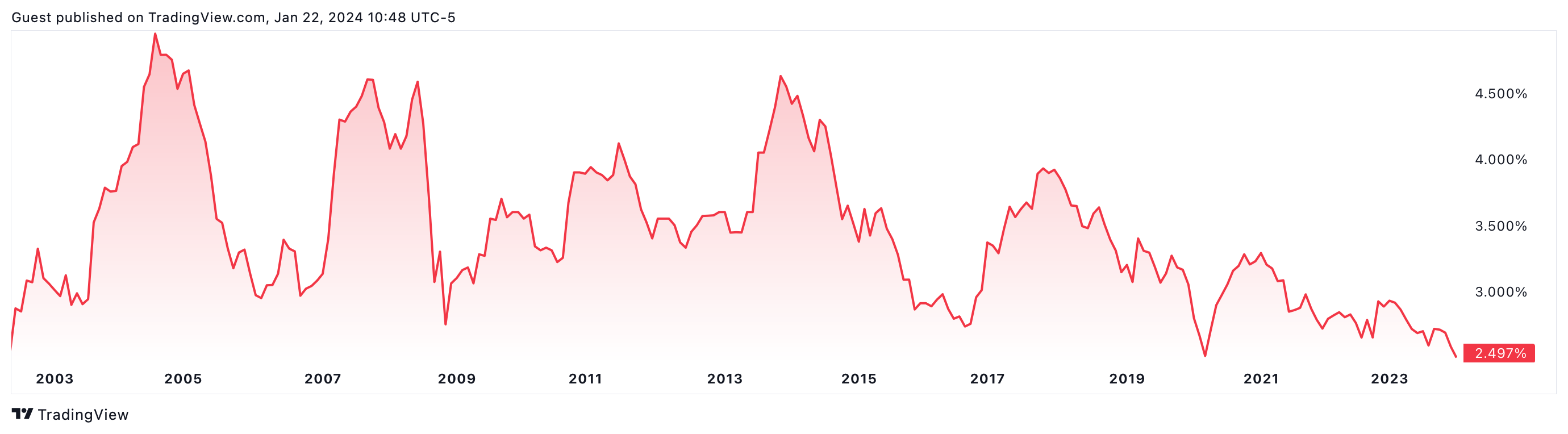

Well-documented policy lags suggest that central banks have done more than enough to reverse the inflationary impulse over the next 12 to 24 months. As the rate of inflation comes down, real interest rates (overnight rate less CPI) rise (better for savers but worse for borrowers) and crimp the economy even after central banks pause and then start cutting overnight rates.

Today, real rates are 2.4% in America, the highest since the 2007-09 recession and 2.7x the long-term average since 1971 (chart below, courtesy of Bespoke). Hoisington Management’s Q4 2023 letter explains real rate impacts this way:

Hoisington Management’s Q4 2023 letter explains real rate impacts this way:

Due to a fall in inflationary expectations, the real Federal funds rate registered a new monthly peak in December, even though the nominal funds rate was last changed in August.

Loans tied to SOFR (the Secured Overnight Financing Rate) would also be higher in real terms. Nominal credit card, automobile, and personal loan rates jumped sharply to new peaks in November. Credit card and six-year new auto loan rates reached 21.47% and 8.67%, respectively, as deposit growth continued to contract. In real terms, these key consumer loan rates are substantial and will impair households’ finances significantly, especially since credit card debt surged dramatically in November.

In a new paper, the Atlanta Fed reviews the popular assertion that the final phase of disinflation will be harder to achieve than the first. It concludes that historical evidence does not support this widely parroted belief. This is why cutting efforts tend to be reactionary, more aggressive and slower to stimulate than previously imagined by the consensus. #noquickfix. See, Is the last mile more arduous?:

After examining a number of potential mechanisms, it is difficult to conclude that the last mile of disinflation is more arduous than the rest. In terms of policy, this implies that the Fed need not view the final phase of the disinflation process as fundamentally different from the other phases. Specifically, the Fed need not exert some sort of extraordinary effort to consistently bring inflation down the last few percentage points to reach its 2 percent target.

From a risk management perspective, believing that the last mile is more strenuous could cause the Fed to tighten policy more than is necessary, which increases the likelihood of a

recession and a sharp increase in unemployment. The inflation surge that began in the spring of 2021 has been reversed, due in part to the Fed’s restrictive policy response, and inflation appears on its way to its 2 percent target. The disinflation has occurred without a substantial increase in the unemployment rate. With inflation approaching its target—albeit in a bumpy fashion—and with relatively strong growth in employment and real GDP, it does not seem prudent to tighten policy due to concerns about the last mile being more arduous. Such tightening would needlessly increase the risk of a hard landing for the economy.