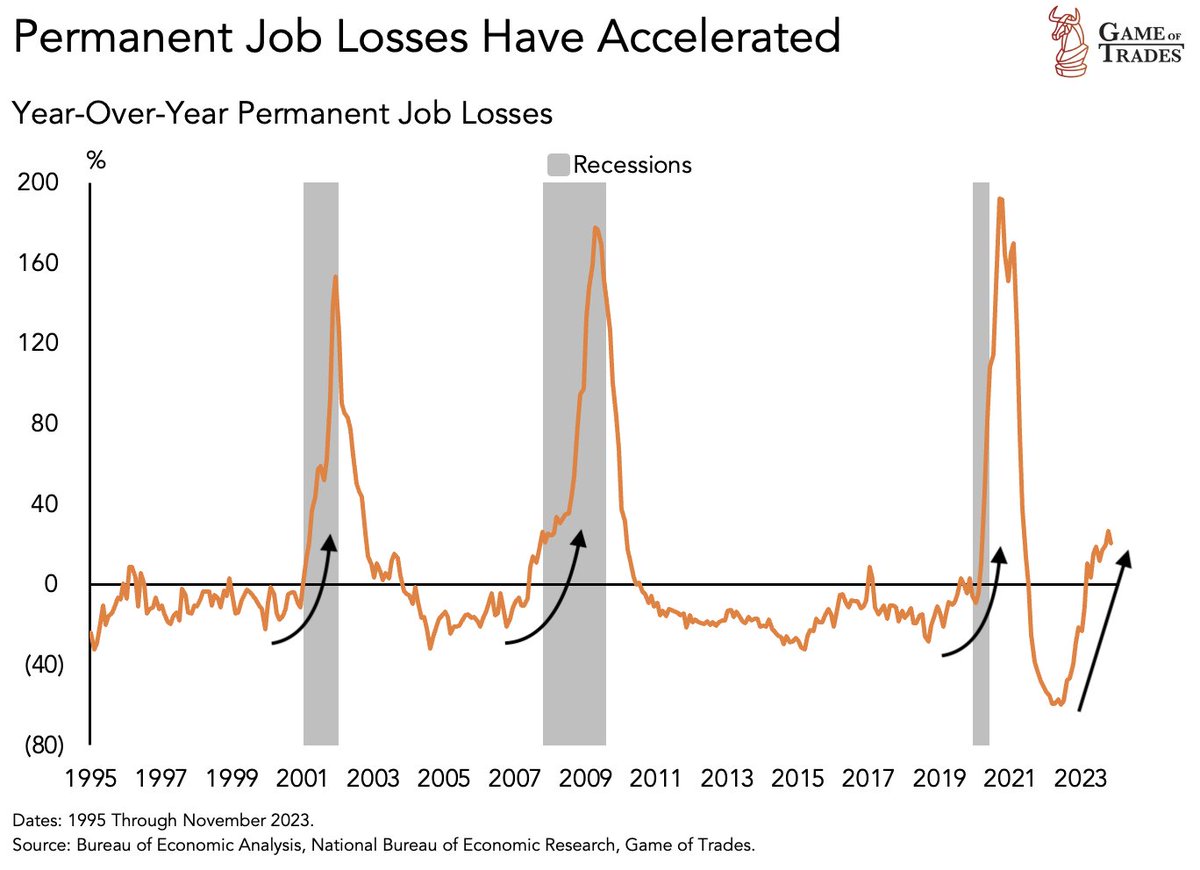

With inflation cooling and unemployment rising, rate cuts are coming into view. Permanent job losses have already accelerated in line with the onset of the past three recessions since 1995 (see arrows and grey bars below, courtesy of Game of Trades). Since 1969, the longest Fed pause time between the last rate hike and the first cut was 14 months (July 2006 to September 2007), and the average was just under five months. Since 1986, the average pause time has been eight months. In all cases, recessions began at or shortly after the first rate cut, with the stock market bottoming 13 to 33 months after the last Fed Hike. March will be eight months since the last hike this cycle, and so far, the stock market remains near its 2021-22 cycle high.

Since 1969, the longest Fed pause time between the last rate hike and the first cut was 14 months (July 2006 to September 2007), and the average was just under five months. Since 1986, the average pause time has been eight months. In all cases, recessions began at or shortly after the first rate cut, with the stock market bottoming 13 to 33 months after the last Fed Hike. March will be eight months since the last hike this cycle, and so far, the stock market remains near its 2021-22 cycle high.

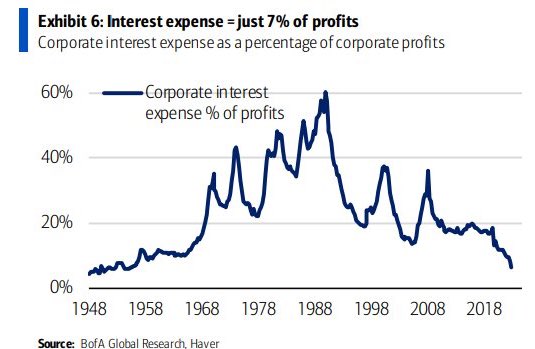

Like households, many corporations locked in term debt when interest rates were at all-time lows in 2020-2021. For this reason, even as rates leapt in 2023, corporate interest payments in the US were just 7% of profits, the lowest share since 1948 (shown below courtesy of Bank of America). This starts to change in 2024 as a record level of corporate debt comes up for renewal every month at higher interest rates. Delinquencies and defaults are rising on all debt types, and this tends to widen credit spreads (lenders demand higher compensation for credit risk/higher rates for borrowers) even as central banks lower overnight rates.

Capital shifting away from corporate credit and equity risk typically flows into government bonds, driving their price up and yields down (10-year yield in red below. since 1989, courtesy of my partner Cory Venable) as recessions unfold (blue bars) and stock markets plummet (S&P 500 in blue).

This hour-long discussion is big-picture rich and worth a mull:

This hour-long discussion is big-picture rich and worth a mull:

On today’s episode, Danielle DiMartino Booth, CEO and Chief Strategist at QI Research, and George Goncalves Head of US Macro Strategy at MUFG for a discussion on what to expect from the Fed, economy & markets in 2024. Will the Fed be able to avoid a recession as markets price in a soft landing? Here is a direct video link.