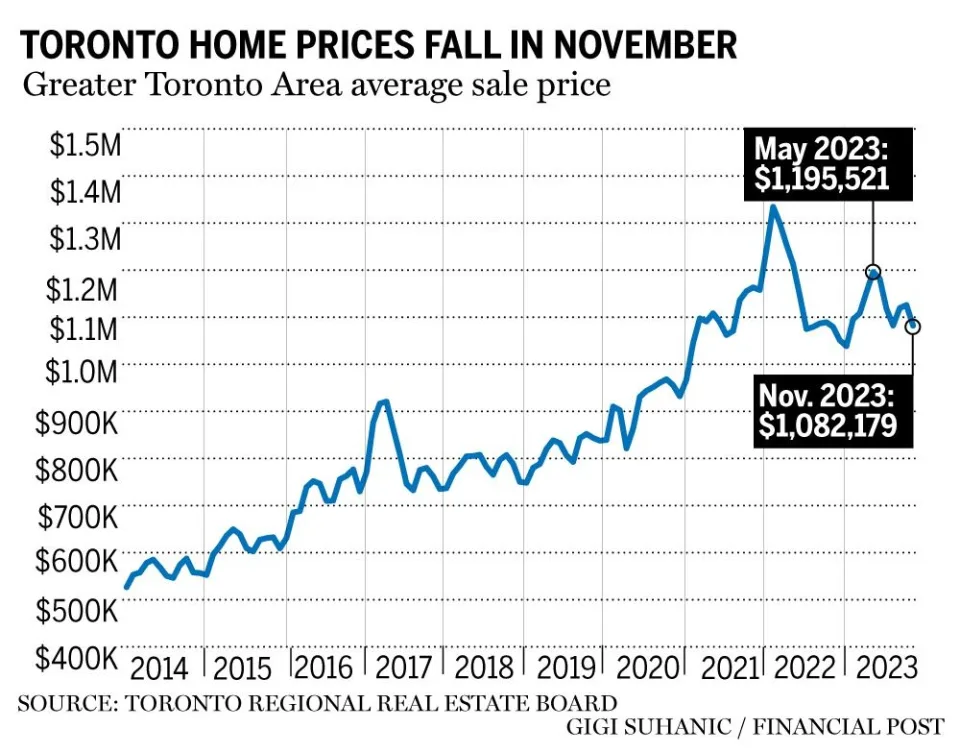

Rebounding Treasury bond prices have lowered mortgage rates from their cycle high in October, but home prices at current mortgage rates are still painfully unaffordable for most.

The Bank of Canada estimates that 45% of Canadian homeowners saw their mortgage payments rise in 2023, and 50% of mortgages initiated before March 2022 will face higher rates by the end of this year. The average payment increase is expected to be 34% and 54% for the most indebted households.

At the same time, home sale volumes have fallen from a national peak of 76,259 in March 2021 to 35,013 in November and an average price of $816,720 in February 2022 to $646,134 in November, a decline of 21% (WOWA chart below).

Would-be-sellers are being advised to hold off until the spring, hoping that lower interest rates will yield more buyers by then. Not everyone can wait and hope, though. Listings are rising, especially in areas where homes are the least affordable. See Hoping for early spring in a chilly housing market.

In November data, new listings in the Greater Toronto Area (GTA) were up 19% year-over-year to 10,545, while active listings soared 41% to 16,759 and far outpaced the 7% decrease in GTA home sales over the past year, down to 4,236.

The average home sold price in the GTA was $1,082,179 for November 2023, representing a decrease of 4% month-over-month and more than 17% lower than the cycle peak in early 2022. GTA home sales accounted for 12% of all Canadian home sales. The GTA had a sales-to-new listing ratio (SNLR) of 40% in November, up from 37% in October. An SNLR under 40 is considered a buyers market. John Lusink, president of Right at Home Realty and Property.ca, says the market is stuck. Buyers point to low sales volumes for negotiating a reduced price, while sellers point to flat year-over-year prices as a reason to hold firm.

John Lusink, president of Right at Home Realty and Property.ca, says the market is stuck. Buyers point to low sales volumes for negotiating a reduced price, while sellers point to flat year-over-year prices as a reason to hold firm.

Trends are not seller-friendly. Mr. Lusink says the inventory of listings on his site was 40% higher in December compared with the same month last year and 100% higher compared with December 2021. For more, see: Toronto just saw the worst year for home sales in 23 years.