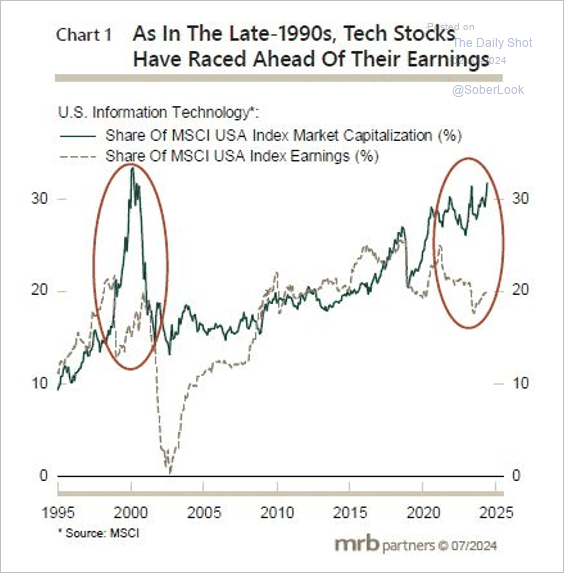

In the second quarter of 2024, big tech companies drove the S&P 500 up 4.3%, while the Russell 2000 index of economically representative small and midsize stocks fell 3.6%.

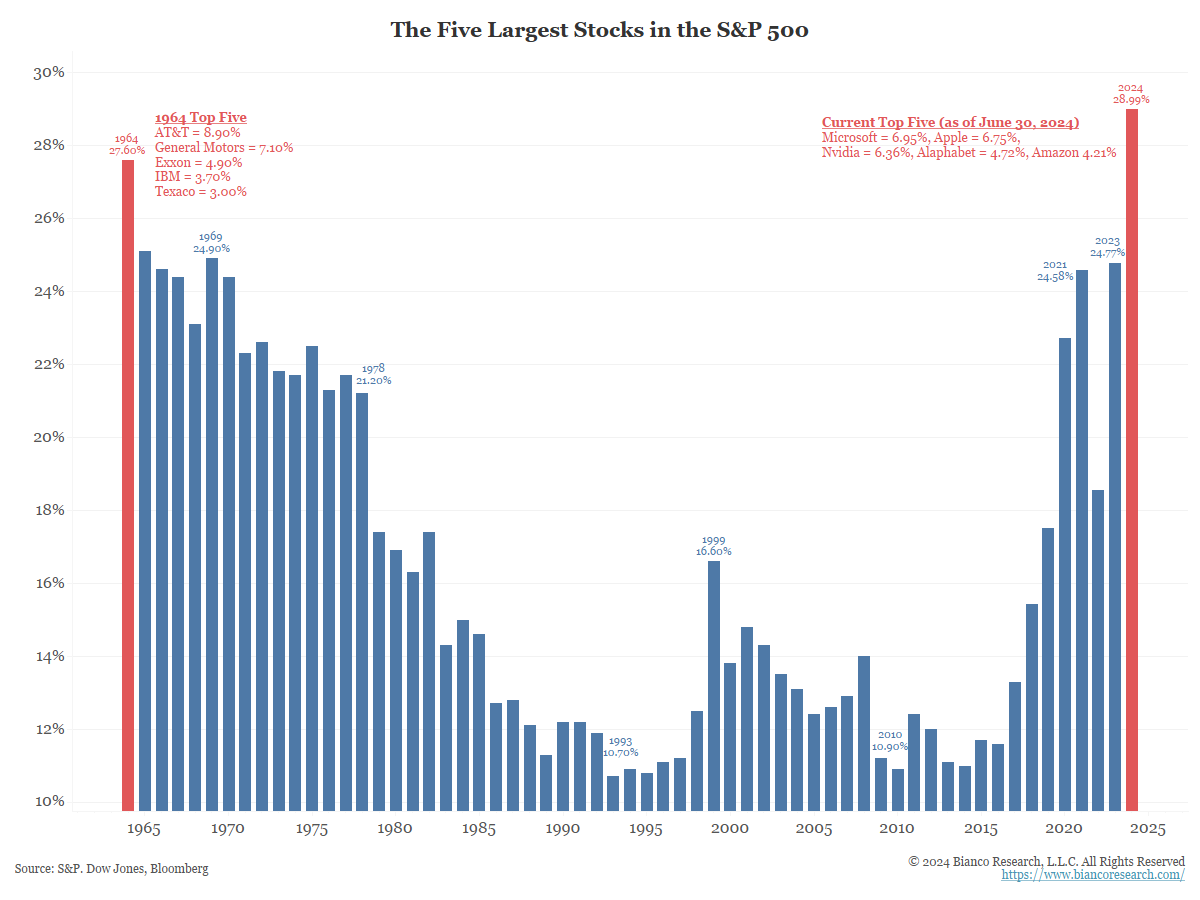

The five most expensive S&P 500 companies now make up a record 29% of the US market capitalization–the narrowest concentration since 1965 and more extreme than in the 2000 tech top (chart below courtesy of Jim Bianco).

It’s worth remembering that 1965 was followed by a secular bear market (Dow Jones Index below from 1966 to 1982, courtesy of Crestmont Research) where stocks tumbled 25 to 45% four times and took 16 years to grow back losses as prices compressed from 21 times earnings in 1966 to 8 times by 1982.

It’s worth remembering that 1965 was followed by a secular bear market (Dow Jones Index below from 1966 to 1982, courtesy of Crestmont Research) where stocks tumbled 25 to 45% four times and took 16 years to grow back losses as prices compressed from 21 times earnings in 1966 to 8 times by 1982.

By 1982, when return opportunities were finally the most attractive in decades with dividend yields above 8 percent, most who held stocks when prices were rich had exited with losses and a lasting disdain for the asset class.

By 1982, when return opportunities were finally the most attractive in decades with dividend yields above 8 percent, most who held stocks when prices were rich had exited with losses and a lasting disdain for the asset class.

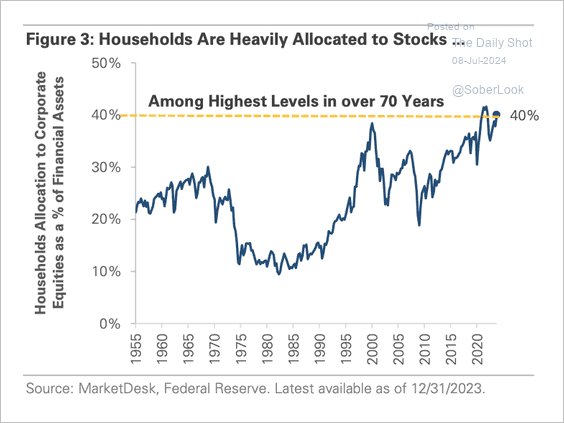

Today, even more than in 1966 and 2000, households are holding the highest percentage of their financial assets in equities in at least 70 years (shown below courtesy of The Daily Shot).

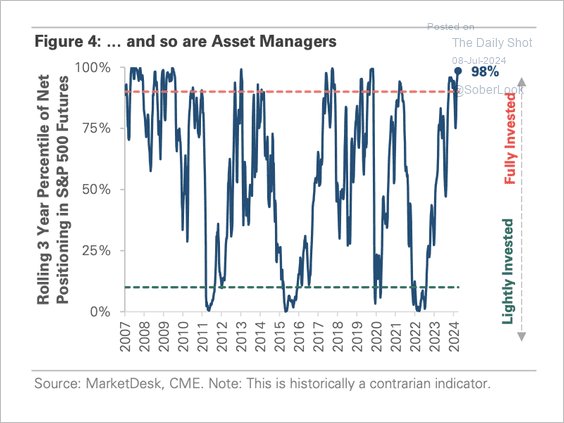

Trying to track the gains of stock indices, the majority of professional asset

Trying to track the gains of stock indices, the majority of professional asset manglers managers are also at record equity allocation, offering dismal risk management for their customers.

Meanwhile, most asset holders are over 50 years old with shrinking time horizons and a low loss tolerance, whether they realize it yet or not. Years of trying to grow back losses will have a negative life impact for most.

Meanwhile, most asset holders are over 50 years old with shrinking time horizons and a low loss tolerance, whether they realize it yet or not. Years of trying to grow back losses will have a negative life impact for most.

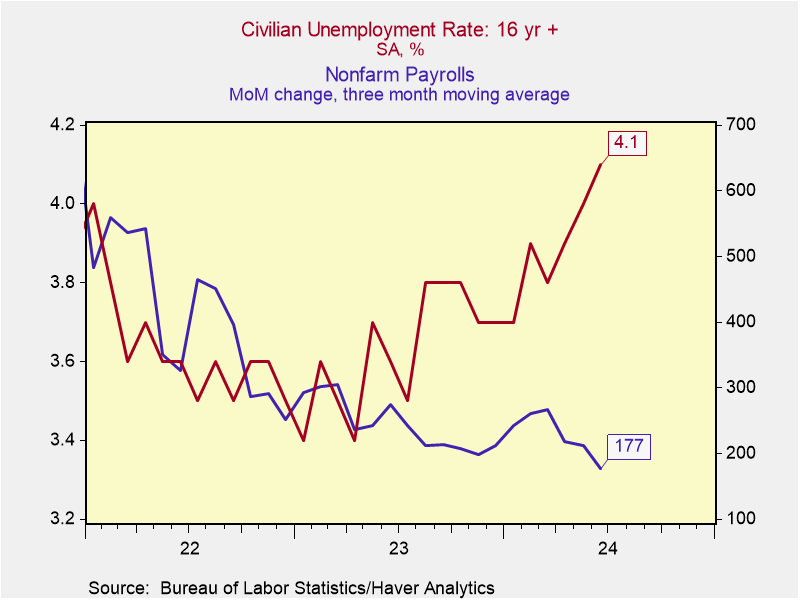

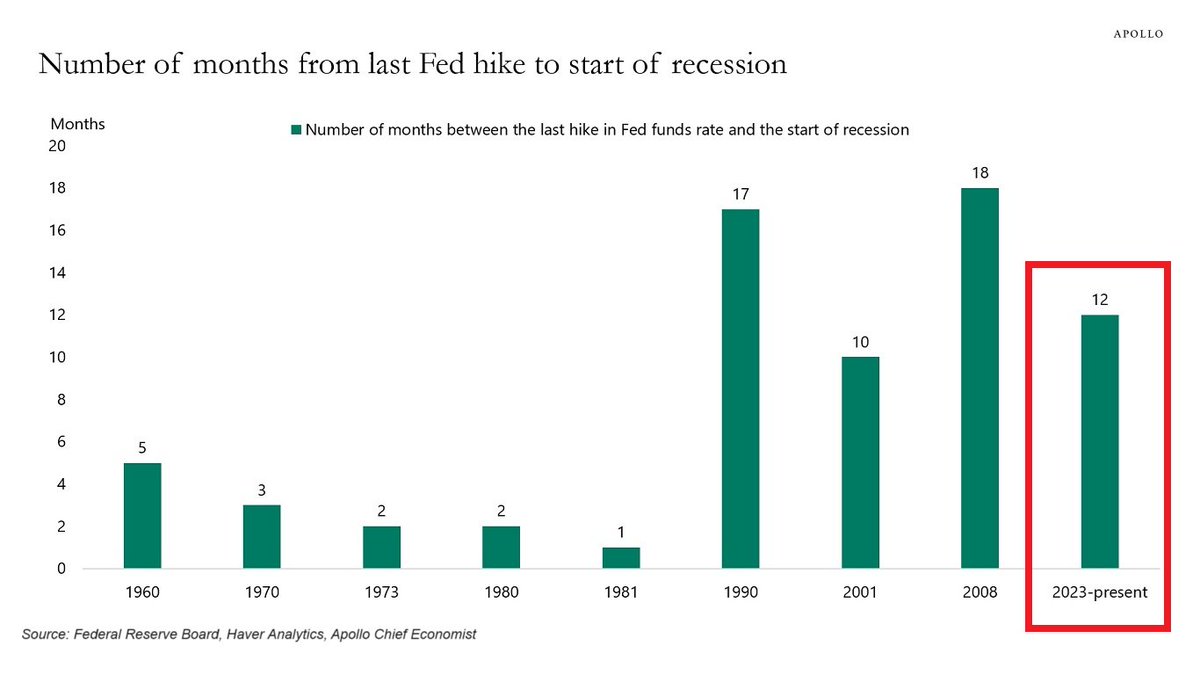

The 28-month (7-quarter) time lag since the start of the Fed hiking cycle in March 2022 has lulled many into unjustified complacency with financial risk. In reality, recessions have followed the first Fed rate hike by a range of 4 to 14 quarters (average of 10) since 1958.

From the Fed’s last rate hike—most recently 12 months ago in July 2023—the onset of recession has taken 1 to 18 months, as shown below since 1960 (courtesy of Apollo).

Longer-than-average lags in the last four cycles were also followed by larger-than-average bear markets. These are facts for thought.

Longer-than-average lags in the last four cycles were also followed by larger-than-average bear markets. These are facts for thought.