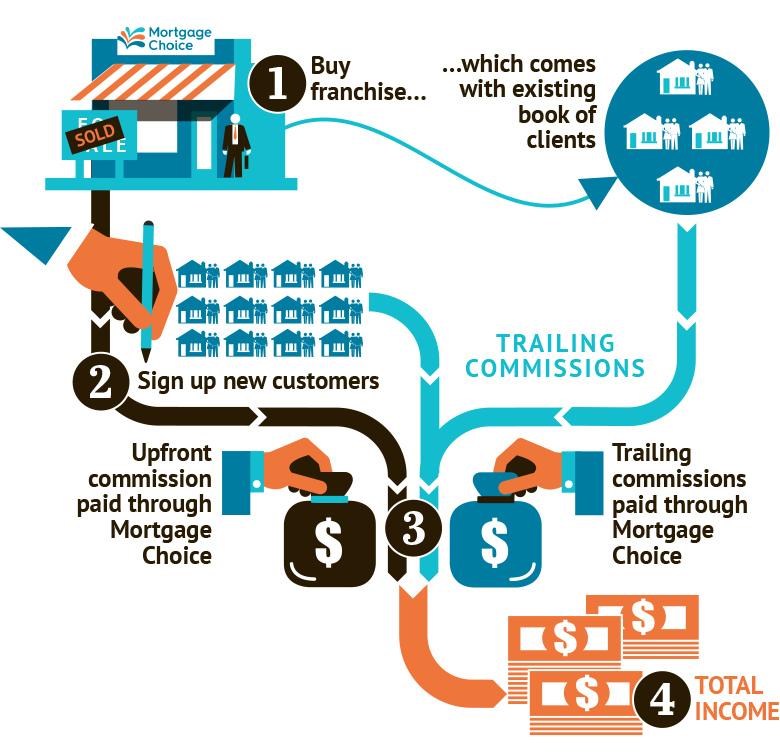

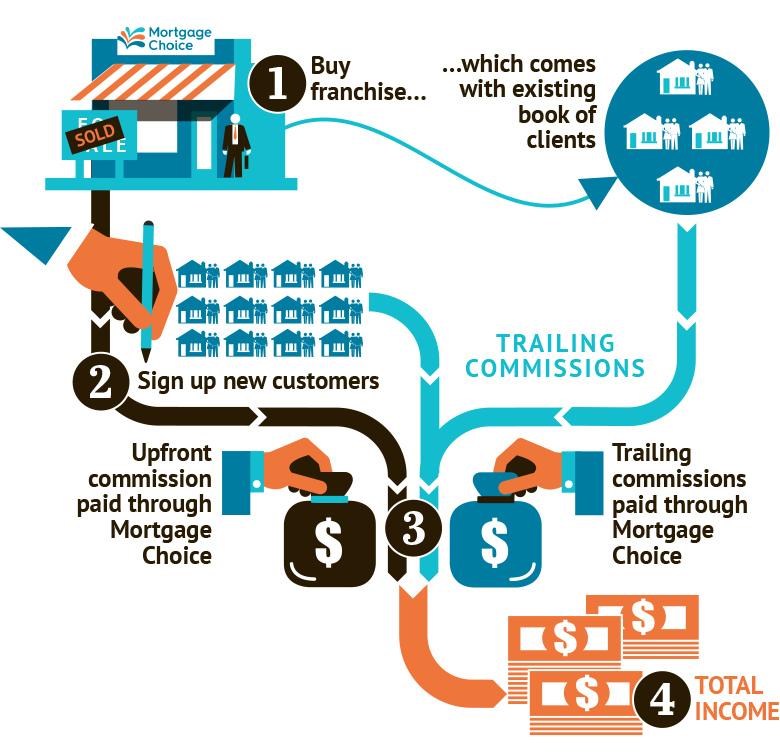

Different country, same destructive lending models as in Canada and everywhere else. Mortgage Choice Limited, commonly known as Mortgage Choice, is a publicly listed Australian mortgage broking firm.

Mortgage Choice is in damage control as it faces an uprising from its franchisees on the back of a business model that is pushing many into financial ruin, depression and cutting corners on arranging loans. May 2018 documents reveal 215 franchisees — almost half the network — are failing to meet a monthly target of $1.5 million of new loan settlements.

See: ‘Desperate people do desperate things’: loan fraud alleged at giant

Here is a direct video link to an ABC Australia report.

Also see: Payday lenders are making bank on high-interest products:

“It’s the same predatory lending schemes in a different package,” said Diane Standaert, director of state policy at the Center for Responsible Lending. “What has remained unchanged for all these years is that the debt trap remains the core of the business model.”