Yesterday as Mother Nature was showing us all who’s boss and pounding Ontario with a mid-April snowstorm, I got to cleaning out the storage space under our stairs–as one does. I came upon a bag of forgotten artifacts and papers. Some of them were letters my mom had written hers in the ’70’s. Others I had written my husband 30 years ago. Some his sister had written to him when he was on a tour of duty in the Middle East in the 1980’s. All so unexpected, I had no idea we had these things.

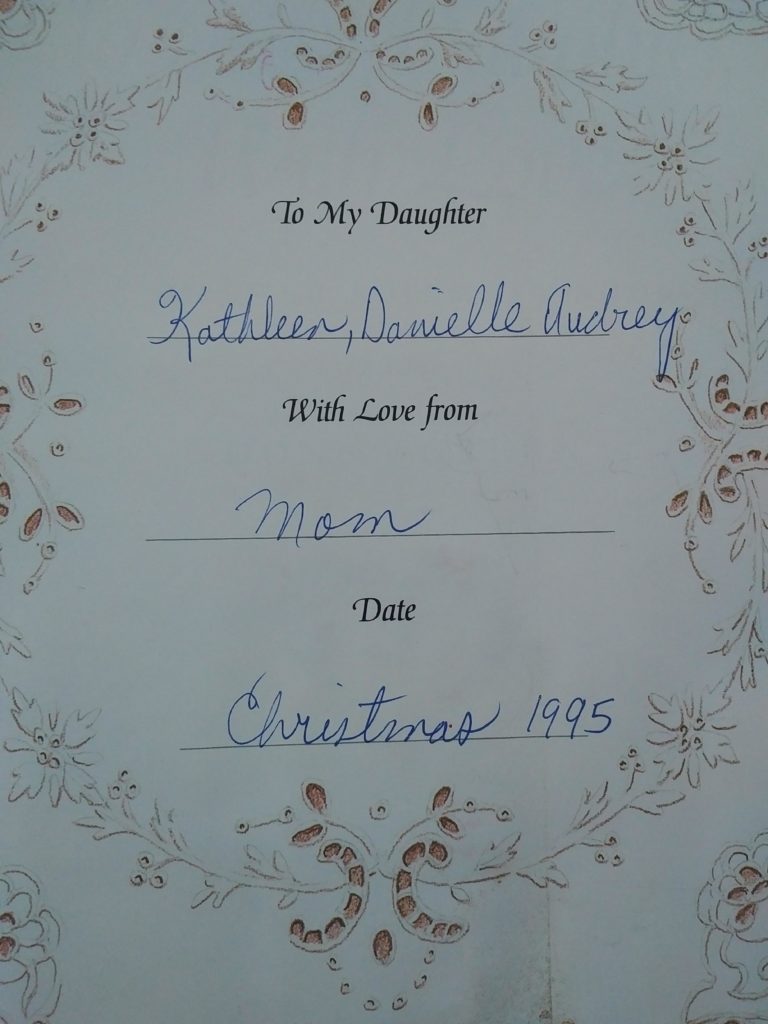

My mother suffered early onset dementia in her late 50’s, and for over a decade has had no language or recognition of anyone. In many ways it’s as if the disease has erased her. And I have struggled to remember what she was like. So, imagine my delight when yesterday, under the stairs, I came upon a book she had put together for me in 1995 when she was 55 and just starting to sense what was coming for her. No doubt it’s why she made me this book, although I had no idea at the time. Inside she has written pages of detail about her parents and my childhood and fond memories she had of our life together. It was as if the past came back from the dead, all in an instant. Needless to say, quite an emotional find. It’s amazing what we forget and then instantly recall, once presented with visual cues.

My mother suffered early onset dementia in her late 50’s, and for over a decade has had no language or recognition of anyone. In many ways it’s as if the disease has erased her. And I have struggled to remember what she was like. So, imagine my delight when yesterday, under the stairs, I came upon a book she had put together for me in 1995 when she was 55 and just starting to sense what was coming for her. No doubt it’s why she made me this book, although I had no idea at the time. Inside she has written pages of detail about her parents and my childhood and fond memories she had of our life together. It was as if the past came back from the dead, all in an instant. Needless to say, quite an emotional find. It’s amazing what we forget and then instantly recall, once presented with visual cues.

Something else I came upon, was a package I had put together before applying to law school, when plan A was to find an agent and become a professional actress and screenwriter. Believe it or not.

Something else I came upon, was a package I had put together before applying to law school, when plan A was to find an agent and become a professional actress and screenwriter. Believe it or not.

The head shots are pure ’80’s. Check the Farah Fawcett.

Life is funny.