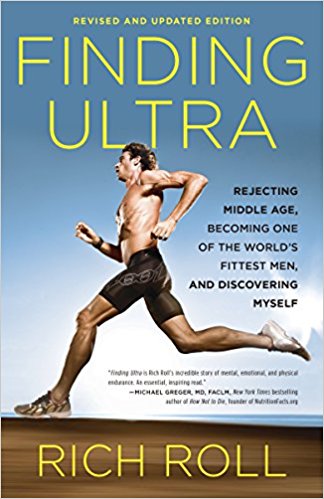

I am just reading Rich Roll’s book “Finding Ultra” and highly recommend it. His interview in this recent #EatForThePlanet podcast is also worthwhile.

I am just reading Rich Roll’s book “Finding Ultra” and highly recommend it. His interview in this recent #EatForThePlanet podcast is also worthwhile.

If you are interested in the wellness space, you are likely familiar with Rich Roll. If not, Rich is a 51-year-old, vegan, ultra-endurance athlete (and we’re guessing you’re probably already pretty impressed by that sentence alone), who is also a bestselling author, host of a highly popular podcast, boasts over 140,000 followers on Instagram, oh and he was recently named “The World’s Fittest Vegan” by Men’s Health Magazine. In the world of wellness influencers, Rich stands above all the rest, known for not only his remarkable athleticism but also his unique and disarmingly honest brand. Today, Rich lives in southern California with his family and says his life is an “embarrassment of riches.” But if you met him about a decade back, you would hardly be able to recognize him. Here is a direct audio link.