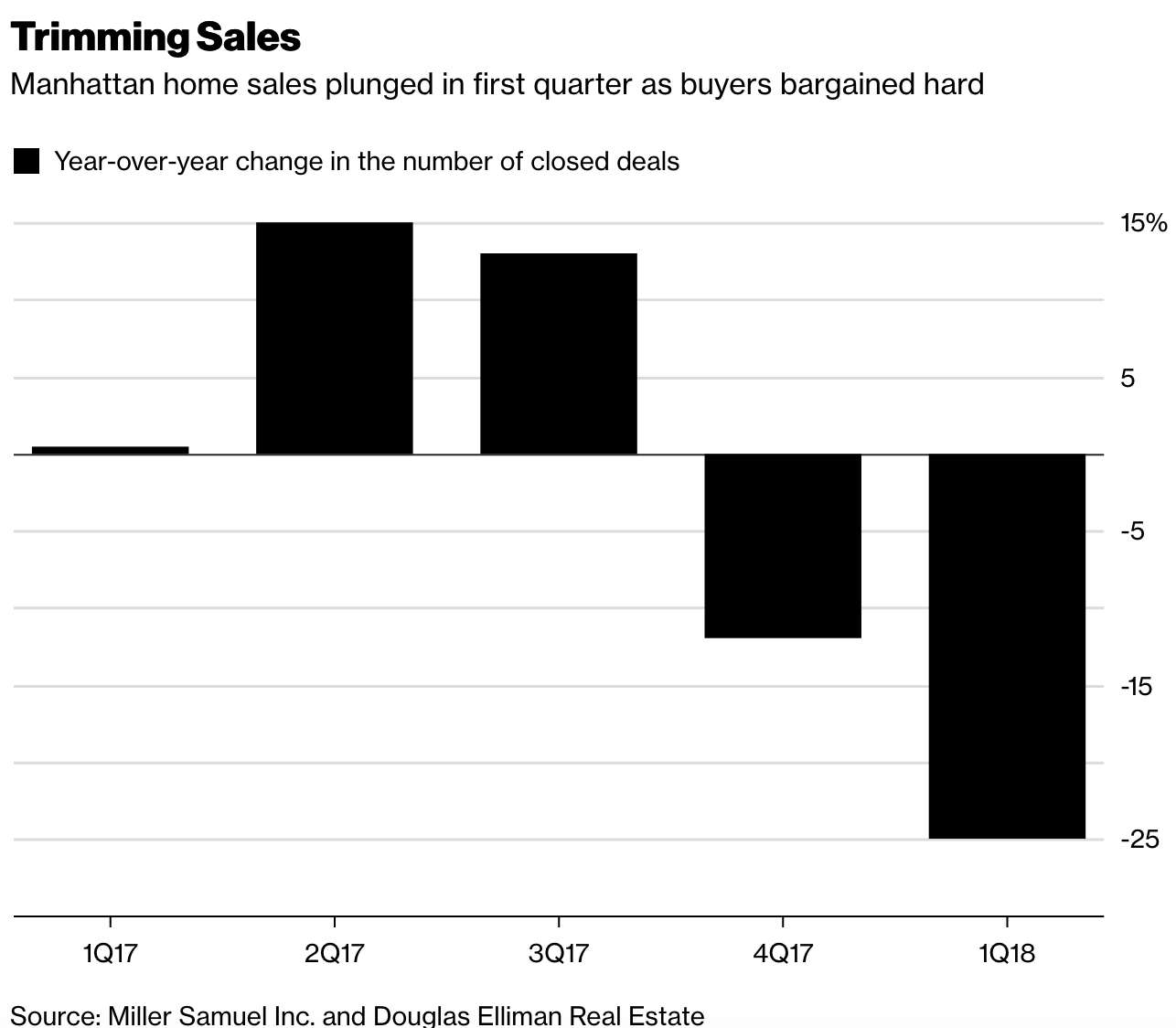

If monthly sales reports won’t help goose up share prices, then we aren’t going to release them anymore. That was the executive decision announced from GM today.

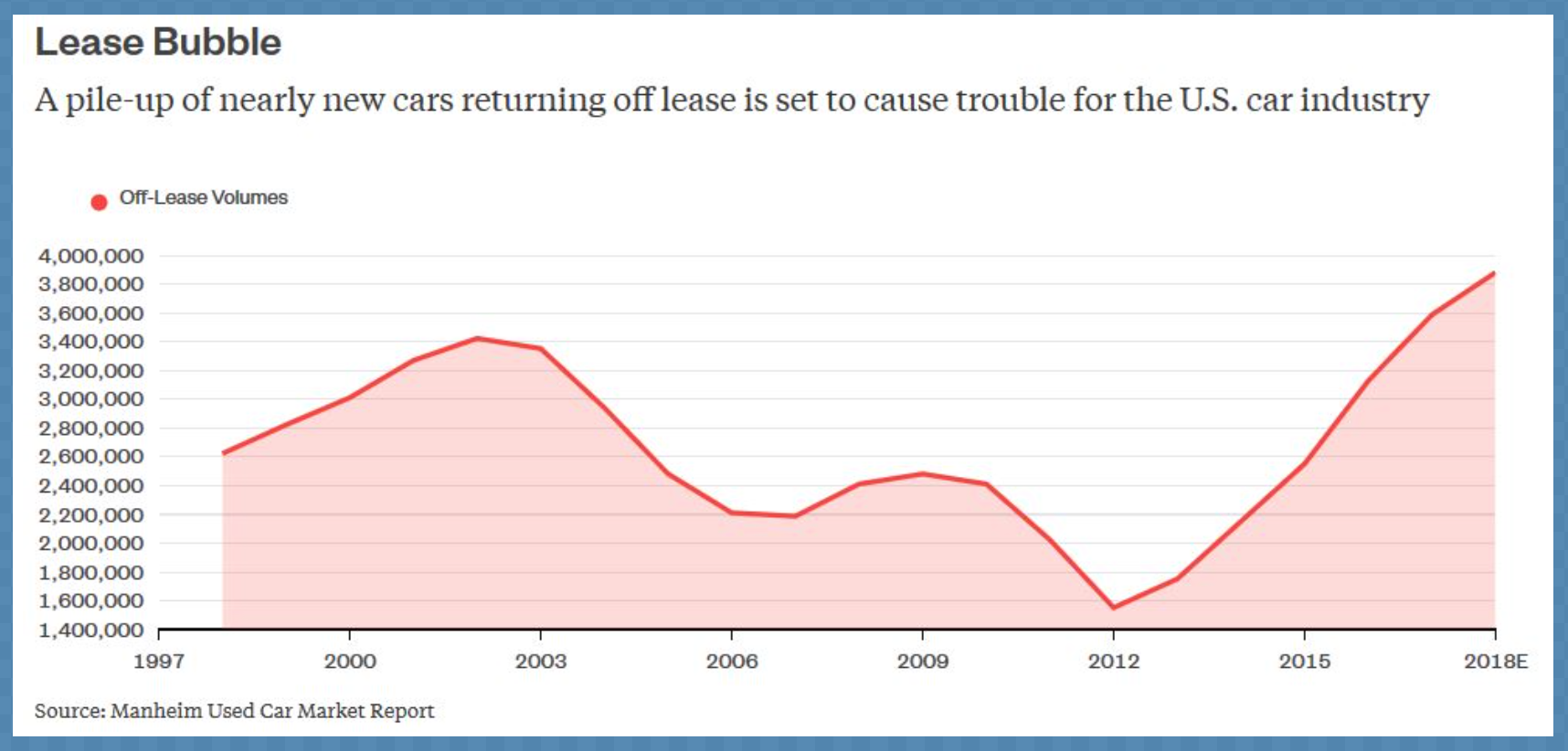

Government bailouts in December 2008, followed by a string of tax-subsidized incentive programs like ‘cash for clunkers’, years of ultra-low rates and lax lending on recklessly long lease terms, all enabled 7 years of unsustainable auto ‘sales’ to 2017. For an excellent summary of how extreme and long-term destructive programs have aided and abetted an antiquated auto business over the past decade+ see Auto Industry bailout: GM, Chrysler and Ford.

The average auto lease in Canada grew to 75 months in 2017 versus 60 months in 2007, and nearly a third of owners had negative equity, owing an average of $6,983 at lease end (JD Power). This makes it harder for owners to trade in their vehicles and buy new ones just as the world is awash in a record auto inventory and heading into a secular downturn in demand thanks to the rise of auto sharing and transportation as a service.

At some point, even zero down, zero interest rates, and payments quoted weekly, aren’t enough to get cash-strapped borrowers behind new wheels. The disappointing auto sales and their hit-to-GDP part of the cycle has returned. See GM Throws wrench in US auto sales by deserting monthly reports:

General Motors Co. will end a 25-year-long practice of disclosing monthly vehicle-sales results and shift to quarterly reporting, complicating investors’ efforts to gauge the health of the U.S. auto market.

“Thirty days is not enough time to separate real sales trends from short-term fluctuations in a very dynamic, highly competitive market,” Kurt McNeil, U.S. vice president of sales operations, said in a statement Tuesday. GM stopped holding a monthly conference call with analysts and media in January 2014 and discontinued releases of monthly production figures months earlier.