US commercial real estate prices have declined an average of 33% since early 2020, with a 60% decline in the office sector. Similar trends are unfolding in Canada.

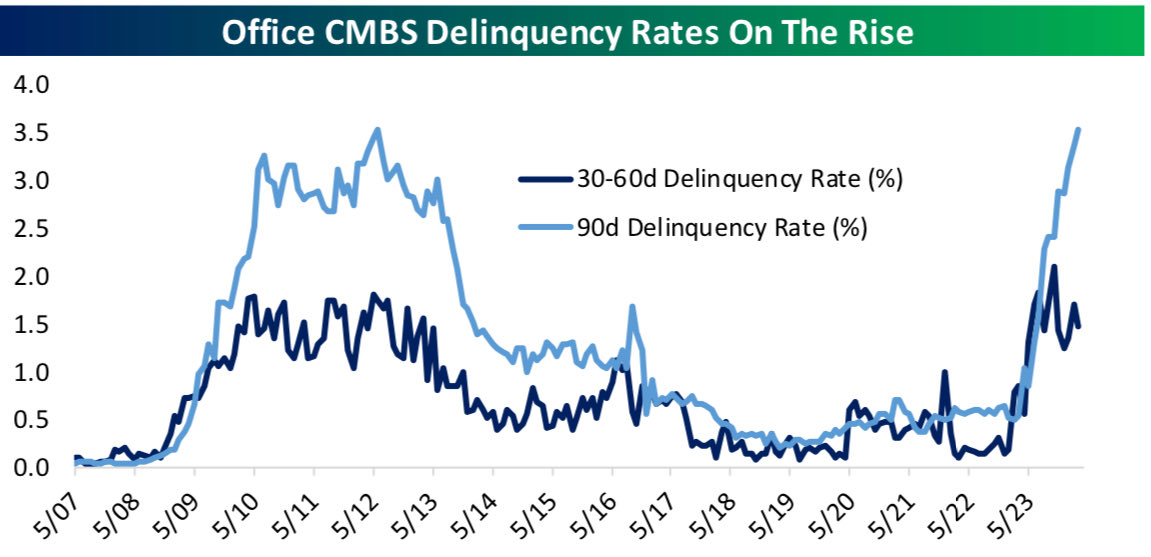

US office loan delinquencies of 30 to 60 days (dark blue below, courtesy of Bespoke) and over 90 days (light blue) have spiked in the past year to levels last seen in 2009.

Delinquencies take some time (and legal process) to translate into motivated sales by owners and lenders. But as price discovery unfolds, other owners and lenders are forced to mark holdings to reflect lowered market values as well.

Delinquencies take some time (and legal process) to translate into motivated sales by owners and lenders. But as price discovery unfolds, other owners and lenders are forced to mark holdings to reflect lowered market values as well.

The segment below discusses the typical contagion impacts of weakness in real estate–the world’s most widely held and leveraged asset class.

Drew McKnight, Fortress Investment Group co-CEO & managing partner, joins ‘Fast Money’ to talk the real estate and banking spaces and why he believes commercial real estate is still a big problem for banks. Here is a direct video link.