Despite a 200 basis point drop in the Bank of Canada’s overnight rate, Canadian mortgage rates have more than doubled from the pandemic’s easy credit days when buyers were engulfed in bidding wars (5-year fixed rates offered by banks, below since April 2020, courtesy of WOW.ca). So far, sellers’ high hopes have kept asking prices elevated, even as the supply of new listings (especially in the 1m+ range) is dramatically outpacing sales in most areas. The average price of homes that have sold offers a reality check.

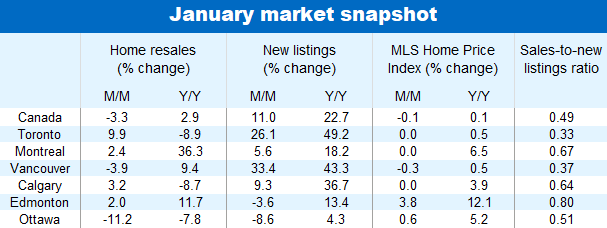

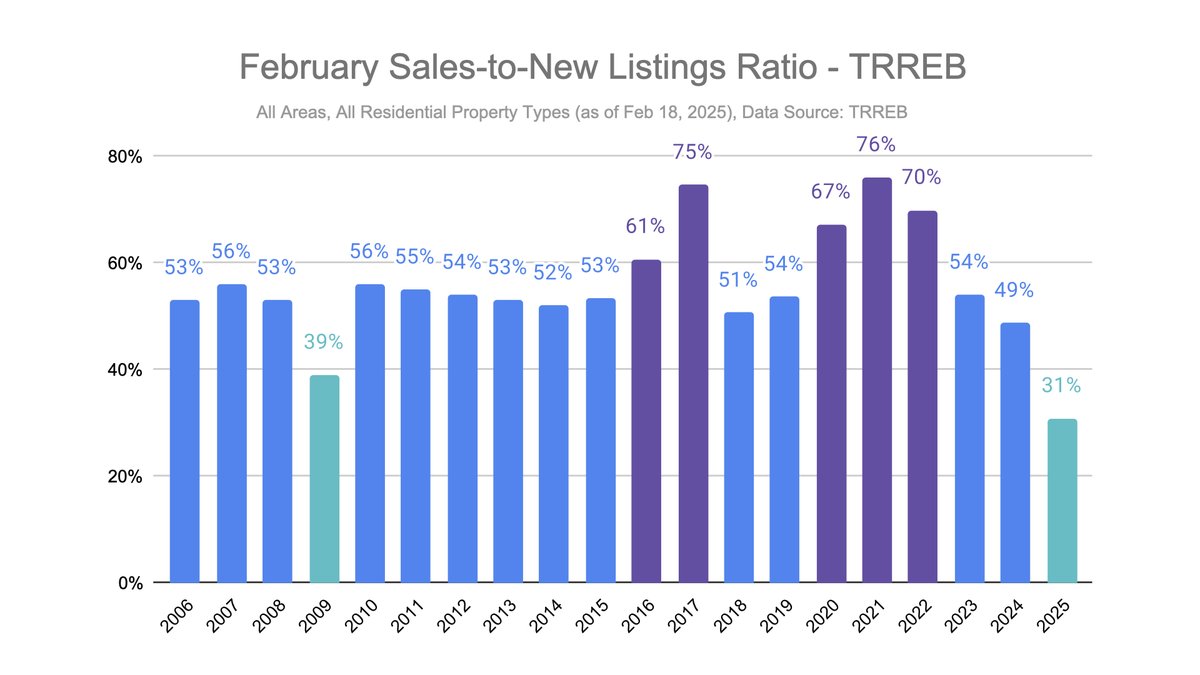

So far, sellers’ high hopes have kept asking prices elevated, even as the supply of new listings (especially in the 1m+ range) is dramatically outpacing sales in most areas. The average price of homes that have sold offers a reality check.

In January, the average home list price in Greater Vancouver was $1,208,415, down 3.6% compared to January 2024, but $193,000 over the average selling price in the past two weeks of $1.15m, down 20.87% year-over-year (the average number of sales in grey and the average sale price in red below since January 2020, courtesy of Property.ca). The average asking price in Toronto was $1,033,742, a 2.7% decrease from the previous year but still $309k over the average sale price for the past two weeks of $724,000 (-33% year over year).

The average asking price in Toronto was $1,033,742, a 2.7% decrease from the previous year but still $309k over the average sale price for the past two weeks of $724,000 (-33% year over year). Surrounding the Greater Toronto Area, cities show similar gaps between average asking and sold prices.

Surrounding the Greater Toronto Area, cities show similar gaps between average asking and sold prices.

In Mississauga, west of Toronto, the average asking price is $977,833 + 2.8% compared to January 2024, but the average sale price the past two weeks was $673,000, -33.3% year over year. In Vaughn, just north of Toronto, the average asking price was $1,033,742, down 2.7% from the previous year, while the average sale price was $681,000, down 48% year-over-year.

In Vaughn, just north of Toronto, the average asking price was $1,033,742, down 2.7% from the previous year, while the average sale price was $681,000, down 48% year-over-year. In Barrie, one hour north, the median list price was $764,109 in January, reflecting a 2.72% decrease from December 2024 but $159,000 above the average sale price in February of $605k, -15% year-over-year.

In Barrie, one hour north, the median list price was $764,109 in January, reflecting a 2.72% decrease from December 2024 but $159,000 above the average sale price in February of $605k, -15% year-over-year.

Affordable home prices compare favourably to rents and household income.

Consider a 600-square-foot, one-bedroom, one-bath, one-parking-space Barrie condo, recently marked down from an asking price of $369k to $325k. The monthly maintenance fees are $554, and the property taxes are $2,071 annually. With a 10% downpayment, the monthly carrying costs amount to $2,583 plus utilities and maintenance (as shown below). Where market rents are less than the total monthly carrying costs, buying remains mathematically unattractive for those looking to occupy the property personally or as an investment to rent out to others.

Where market rents are less than the total monthly carrying costs, buying remains mathematically unattractive for those looking to occupy the property personally or as an investment to rent out to others.

Similar units are offered for rent at $2,100 a month, suggesting a negative carry of $483 a month even before maintenance costs or any special condo fee assessments.

Similar units were selling for closer to $500,000 in the mania of 2021-2022. So anyone who bought back then is underwater. While the current asking price of $325,000 is moving in the right direction, it remains some 4.6x the median Canadian household income, around $70k annually.

Historically, the well-established ‘affordable’ norm is about 3x household income, or a home price of approximately 210K today. So, a $325k list price is still too high.

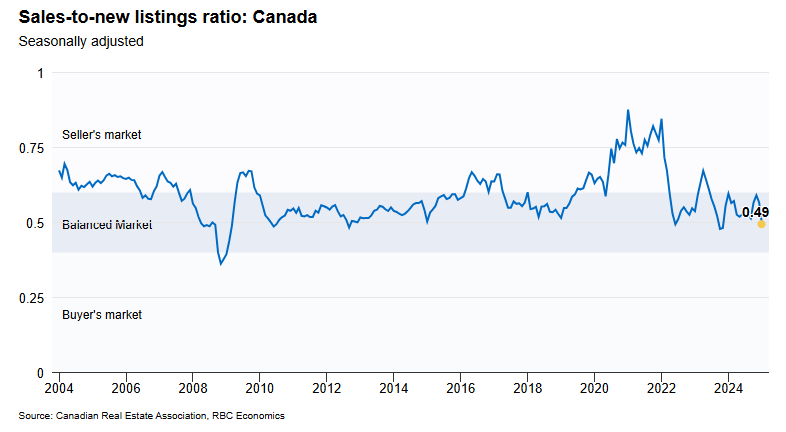

As more properties are listed for rent and sale, the cost of shelter is coming down. See, Canadian home listings surged in January. That will be a big plus for future buyers and renters as excesses of the recent property bubble reverse. More downside progress is needed, and the spring market is set to be revealing.