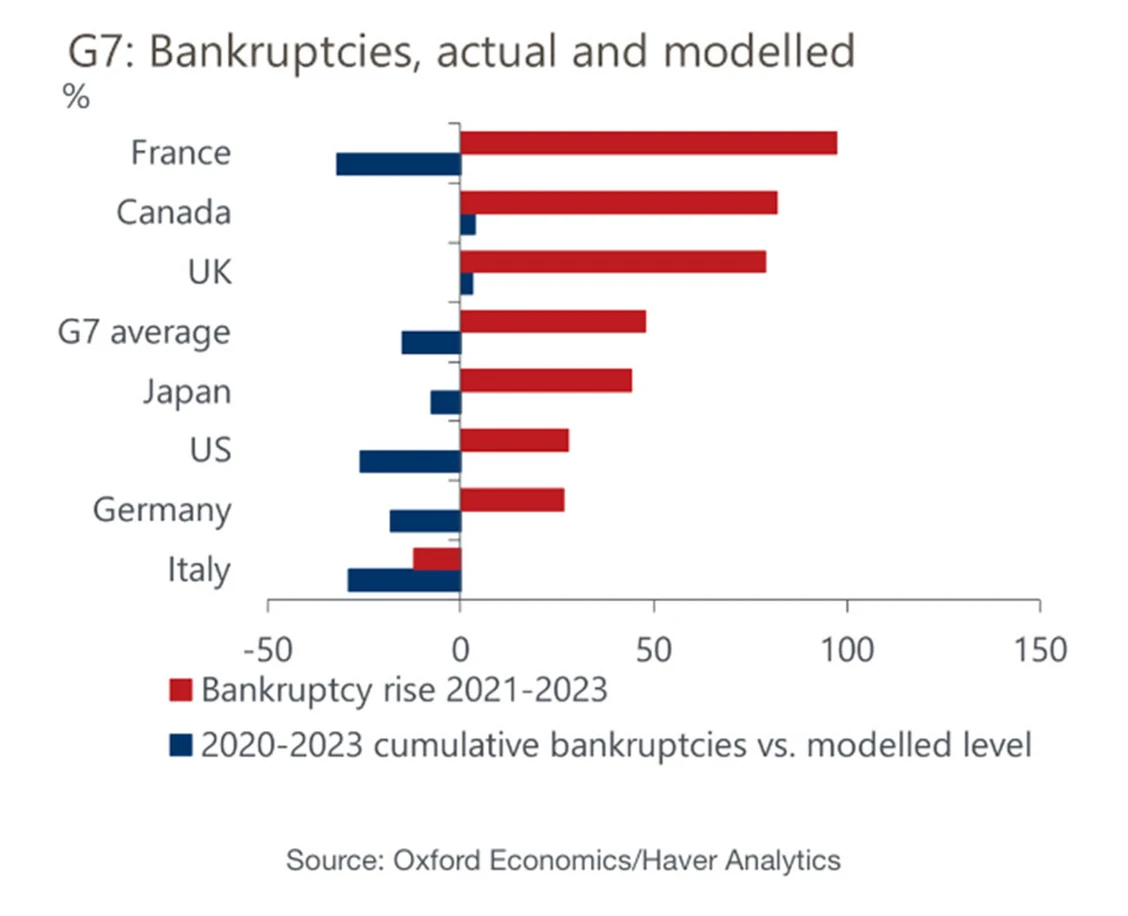

Business insolvencies are rising globally (chart below via The National Post), and Canada is seeing twice the G7 average. Canadian business insolvencies rose 35% quarter-over-quarter in the final quarter of 2023. They doubled compared with the same quarter in 2022 and were at the highest level in 1 3 years (Office of the Superintendent of Bankruptcy).

3 years (Office of the Superintendent of Bankruptcy).

With the Canadian unemployment rate still under 6%, credit appetite has slumped. Canadian household credit growth in real terms is flat for the first time on record. This negatively impacts the outlook for economic demand, lenders and the highly leveraged realty market.

In their quarterly earnings reports this week, Canadian banks are increasing loan loss provisions and warning that the trend will continue as unemployment rises; see Scotiabank and BMO brace for higher impaired loans as interest rates weigh on consumers.

In the quarter, Scotiabank set aside $962-million in provisions and BMO reserved $627-million – more than the banks booked in the same quarter last year and higher than analysts had expected. The bulk of those provisions were put toward impaired loans, or debt that a bank believes will not be repaid.

Nick Gerli (video below) reports real-time and historical US real estate data. Canada’s trends and numbers are similar and worse in critical metrics like home affordability, household indebtedness, economic strength and unemployment. Rising defaults lead to foreclosures, empty properties, higher supply and lower prices.

Everything is the rate of change at the margin. A relatively small percentage of defaults is often enough to trigger significant price declines. This cycle is happening now in many areas. Look around you…

The foreclosure rate in America’s Housing Market is still at a fairly low level overall – about 0.2% of all houses. But it has now started to rise due to elevated debt-to-income ratios for existing homeowners. Many are struggling to pay their bills and going into default on credit cards, auto loans, and now mortgages. In the last Housing Crash from 2008-12, the foreclosure rate in America peaked at 2.0% of all housing units. And in some markets, the foreclosure rate hit over 10% of all mortgages (like Miami and Las Vegas). It’s unlikely the mortgage defaults in the housing market get that bad again. However, the concern for home prices and existing homeowners is that even a small uptick in foreclosures from current levels could cause significant downward price action, particularly in areas that have low inventory. Here is a direct video link.