Big rally today. I would like to believe that this was the pivotal 90% up day on the Dow that will signal the start of the next bull cycle. I doubt that it is but I would be happy to get on with the next bull when it chooses to start. In the meantime though, we will have to see some follow through in the next few days. One day is no trend. And as we have seen vividly over the past many weeks, huge one-day moves up have not, so far at least, changed this bear market's course.

It could be that after awesome selling pressure in the past 2 months, desperate sellers have finally been exhausted. At least for a while. I believe that deleveraging and institutional margin calls have been the dominatrix of world markets for the past many weeks. This has forced the Lowry's Selling Pressure Index to record levels day after day. But even with the huge buying today Lowry's Selling Index only dropped 4 points. Interesting. Maybe this was just another short squeeze rally today. World markets have been technically very over-sold, so a big bounce was within the realm of possibility.

Speaking of shorting. People often ask me about shorting and whether they should do it in down markets to beef up gains. Others have asked why my management company is a long and neutral firm rather than a long, short firm. Today offers a good explanation. We manage life savings for our clients. We are not their venture capital. On a violent rally like today, shorts can literally go bankrupt. Those holding the 2 x leverage short ETF's lose more than 20% in one day like today. Shorting sounds very cool when it works out. When it doesn't it can be lethal. I find that in real life, very few people are up for lethal. John Authers has a good clip on short trauma here.

Maybe we will see a rally over the next few months. Maybe it will break down again to a final cycle low after that. One thing for certain is that this is no market to be blindly jumping in or holding. If we do start to toe into a sustained rally in the days ahead, we will do so tenuously and in tranches. And we will always keep an eye on our exit in case things break down again. This is no market for big bold jumps and stubborn opinions.

Follow

____________________________

Cory’s Chart Corner

Load MoreHeadline chasing algos need to do deeper dives...

h/t @hussmanjp John P. Hussman, Ph.D. @hussmanjp

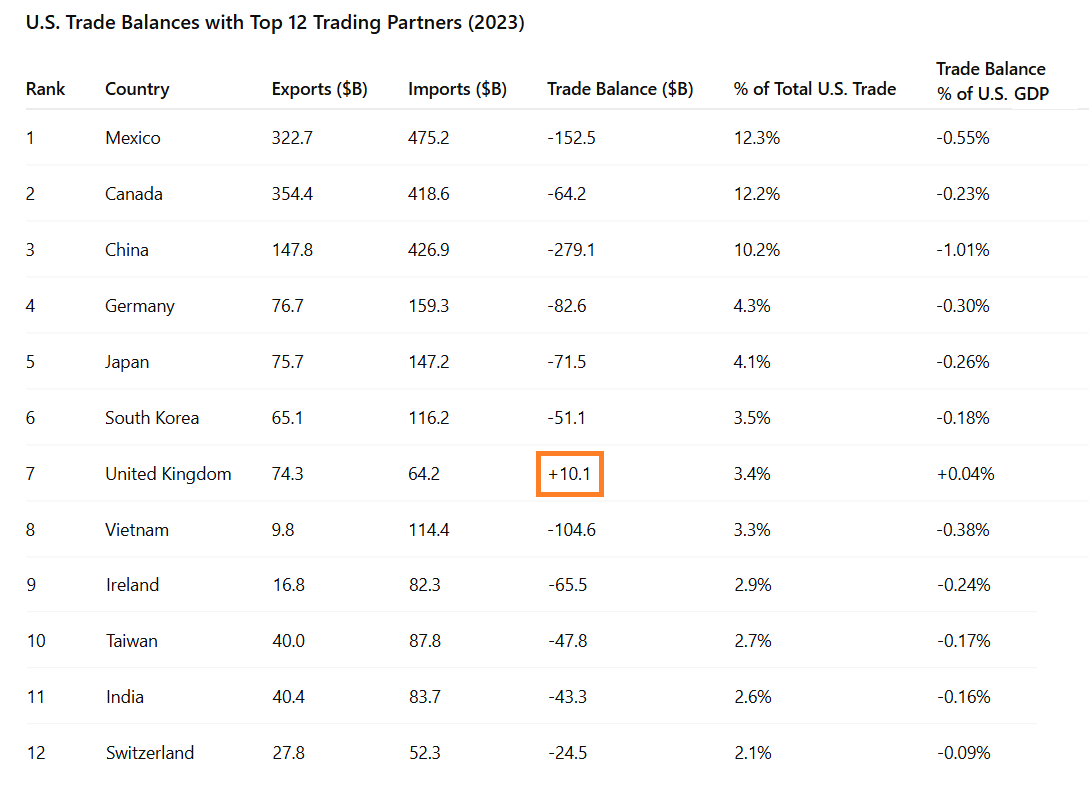

John P. Hussman, Ph.D. @hussmanjpy'all realize the UK is only about 3% of U.S. trade, the U.S. already runs a surplus there, and the 10% U.S. tariffs will stay, right?

keep in mind that studies indicate U.S. consumers shoulder the majority of tariff incidence, with minor incidence to foreign countries____________________________

Danielle’s Book

Media Reviews

“An explosive critique about the investment industry: provocative and well worth reading.”

Financial Post“Juggling Dynamite, #1 pick for best new books about money and markets.”

Money Sense“Park manages to not only explain finances well for the average person, she also manages to entertain and educate while cutting through the clutter of information she knows every investor faces.”

Toronto SunSubscribe

This Month

Archives

Log In

You ain't kidding. My HXD is down some 6 bucks on the day. And it was all going so well…

Marcus