Over the past 30 years, banks went from being a utility in service of entrepreneurs and the greater economy to being drug dealers manufacturing credit and leverage to feed the endless aspirations of governments and consumers. Not to mention the drug lord like compensation of investment bank executives. We have seen this cycle many other times in history in other periods and other countries. Eventually the banks implode, taking the credit machine and co-dependent economies down with them. Eventually the parasite kills the host, and the economy has to reboot and rebuild sober out of rehab. This cycle, the mantra of globalization took the scourge of banks viral all over the planet.

At the peak in 2007 you could rarely find a fund manager or “investor” who was not madly in love with banks: “we love the banks in here” was the most typical comment on business television. For us it was a true sign that the manager had checked their brain at the door of critical thought and active risk management. We hear it less today, but many people still think of the banks as the “must have” sector for income and earnings growth.

My own take is that banks are likely to disappoint on earnings growth and revenue in the new post credit bubble norm going forward. The sector has been underperforming year to date but I think there is very likely more downside to go before we will be content to buy them again as a utility like investment that provides dividend income and some slow capital growth.

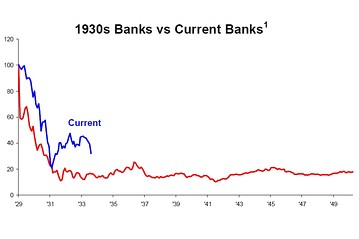

The following is a chart of the S&P money center bank index for the 1930s and the KBW bank index for the present day. Both are indexed to the start of their crashes. Investors suffered lost decades on their U.S. banks following the Depression. Similarly, the share price of Japanese banks suffered the same long-term fate following the collapse of their housing bubble in the late 1980s. Although the performance of U.S. banks is not doing as badly as they did in the 1930s (yet), the road to recovery may be long. Hence why it is best to let the banks reprice to this reality first before committing our capital there.

Chart sourced from Birinyi Associates via the Wall Street Journal

The Fed Cannot Stave Off the Inevitable Market Revaluation

http://www.oftwominds.com/blogaug11/staving-off-inevitable-8-11.html

Is the SEC Covering Up Wall Street Crimes?

http://www.rollingstone.com/politics/news/is-the-sec-covering-up-wall-street-crimes-20110817

Epic $23 Billion In Domestic Stock Fund Redemptions Dwarf Post-Flash Crash Outflows

http://www.zerohedge.com/news/epic-23-billion-domestic-stock-fund-redemptions-dwarf-post-flash-crash-outflows

Why Modern Democracy Is For Idiots

http://www.zerohedge.com/news/guest-post-why-modern-democracy-idiots

Looking back from the date of your post, Danielle, this was an exceptionally prescient call (a bit of luck in timing, but spot on in fundamental analysis). To make the point, just look at this “basic chart” on Yahoo Finance the SPDR Sector ETF for Financials (XLF) for a 10-day slice of its market price (Aug 12 to 22) http://yhoo.it/r4sUae