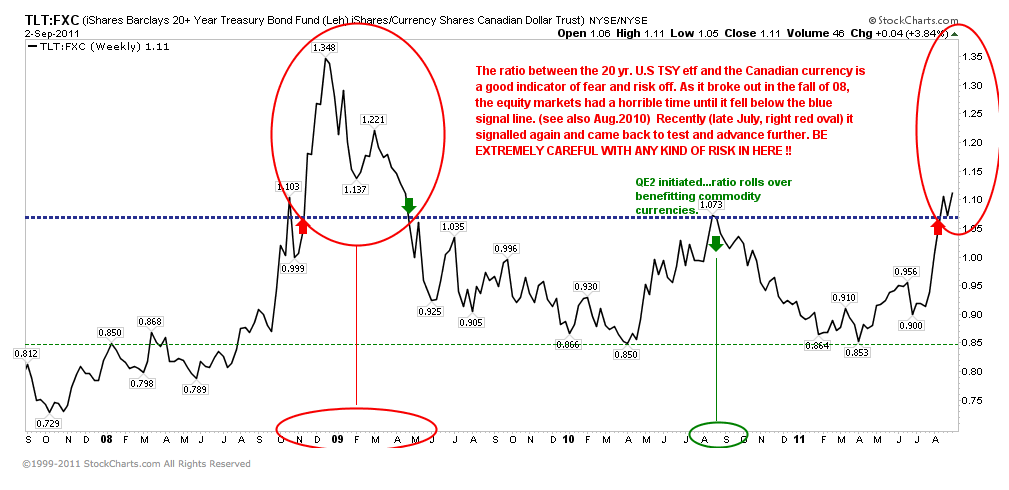

The fear trade has come to life the last few weeks and the above chart from Technician Cory suggests fear may well be here to stay for the next several weeks. Here he shows the US long bond index “TLT” as a ratio over the Canadian dollar Index “FXC”. When the TLT moves up more than the FXC we see the deflation fear trade has the upper hand over growth or inflation prospects. The TLT ratio came up to resistance in August last summer and then rolled over on the euphoric hopes that QE2 would revive growth. Lately as this hope has been dashed, the TLT/FXC ratio has broken out just as it did in the fall of 2008. Harbinger of things to come?

The fear trade has come to life the last few weeks and the above chart from Technician Cory suggests fear may well be here to stay for the next several weeks. Here he shows the US long bond index “TLT” as a ratio over the Canadian dollar Index “FXC”. When the TLT moves up more than the FXC we see the deflation fear trade has the upper hand over growth or inflation prospects. The TLT ratio came up to resistance in August last summer and then rolled over on the euphoric hopes that QE2 would revive growth. Lately as this hope has been dashed, the TLT/FXC ratio has broken out just as it did in the fall of 2008. Harbinger of things to come?

Follow

____________________________

____________________________

Danielle’s Book

Media Reviews

“An explosive critique about the investment industry: provocative and well worth reading.”

Financial Post“Juggling Dynamite, #1 pick for best new books about money and markets.”

Money Sense“Park manages to not only explain finances well for the average person, she also manages to entertain and educate while cutting through the clutter of information she knows every investor faces.”

Toronto SunSubscribe

This Month

Archives

Log In