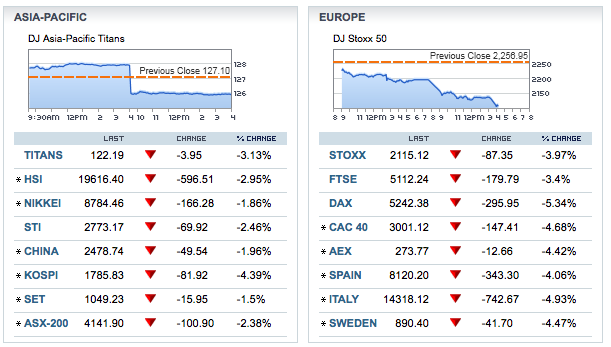

For the past year as we have watched the Eurozone extend and pretend, deny and hope, in round after round of unrealistic promises and projections, I have been thinking we would wake up one morning to news that European politics, banks and markets were imploding. Today seems to be the day. As North American markets are closed for the last long weekend of summer, Europe and Asia are a sea of red with the US dollar, bonds, and gold bullion getting the relative “safe haven” bid.

As we are now in the midst of the third cyclical bear market since this secular bear began in 2000, I cannot help but feel sorry for all the people married to the ‘long always’ mantra, managers and advisors.

I think about the handfuls of clients who left our firm in the past few years because they were seduced by the promise and hope of bigger gains elsewhere. It is a painful reality that in managing risk properly, in looking out for our clients’ best interests ahead of all other agendas, we must take people out of harm’s way at certain points in these cycles and each time we do, there are some who chose to run back into the burning building led by others who promise them that it is warm.

My great hope is that each loss experience offers the opportunity for change, learning and wisdom. In this way, experiences of loss can benefit us a lifetime.

“It’s hard to see any reason, any long list, or any convincing list of reasons to be long of equities through this turmoil,” Nick Parsons, head of strategy for National Australia Bank, tells CNBC in this next clip. And apparently he is “not in the business of clutching at straws.” This is good…

I actually thought your advice was rather sage. However, I can see why some people stay “at the party” till the trouble starts … who wants to “miss” the fun in between then.

People get suckered in by smooth talkers all the time. However, at the end of the day the numbers never lie.

Please comment on your views on gold. As far as I can tell from your past comments you have not been invested in gold.

Our view continues to be if you believe in gold as a valuable store of energy as an alternate currency then you should hold gold bullion or coins in your own safe. Not paper asset versions like gold ETFs, gold shares and funds as they trade as paper assets in market crisis, but physical gold if you believe in it.

I hold the GLD ETF and it trades right in line with gold. The bid/ask spread on coins is about 4% on the ETF it is only pennies. Do you think the gold ETF is somehow more risky than gold? Do you recommend physical gold to your clients?

In the last credit crisis, gold ETF’s sold off with other paper assets. Forced liquidation and margin calls on levered players causes panic selling across all publicly traded markets, even assets they may otherwise wish to hold on to.