Good article this morning on the growing anger and anxiety among financial executives. Evidently the new de-leveraging phase is proving to be much less fun and profitable than the leveraging up phase that made the banks billions in phantom profits:

“Wall Street executives, facing demonstrators camped for a fourth week in New York’s financial district, say they’re anxious and angry for other reasons.

An era of decline and disappointment for bankers may not end for years, according to interviews with more than two dozen executives and investors. Blaming government interference and persecution, they say there isn’t enough global stability, leverage or risk appetite to triumph in the current slump.

“I don’t think it’s a time to make money — this is a time to rig for survival,” said Charles Stevenson, 64, president of hedge fund Navigator Group Inc. and head of the co-op board at 740 Park Ave. The building, home to Blackstone Group LP Chairman Stephen Schwarzman and CIT Group Inc. Chief Executive Officer John Thain, was among those picketed by protesters yesterday. “The future is not going to be like a past we knew,” he said. “There’s no exit from this morass.”

The whole article is worth reading see “Wall Street Sees ‘No Exit’ from financial woes”

But there is an exit here: it just requires a few years of paying back and writing off chunks of the outrageous debts that were levered on to the world in the financial wizardry of the past 20 years.

Oh and we may need to take back a few of the mansions and other personal windfalls that bankers collected over the past few years as they helped drive the global economy into the ditch. Some States are reportedly working on legislation that would allow prosecutors to do just that. Hey, easy come-easy go becomes–you took unfairly, failed your duties for prudent stewardship, and now you have to give back.

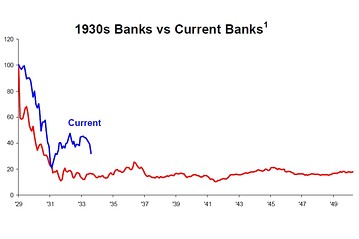

I am reminded of this chart of the financial sector share prices from the peak in 1929 to the end of that 20 year de-leveraging period as compared with today’s banking index from its most recent peak in 2007 to now. The sector will be a buy again once share prices have declined enough to reflect the new world where banks return to being not growth stocks but boring utilities with a steady dividend.