Here is the latest update on the US 10 year Treasury yield, which has served as a useful sentiment barometer over the past many years. So far yields remain in a down trend, suggesting the contraction in risk asset prices is not yet complete and the US dollar and bond markets are still receiving relative safe-haven in flows of global capital.

Source: Cory Venable CMT, Venable Park Investment Counsel Inc.

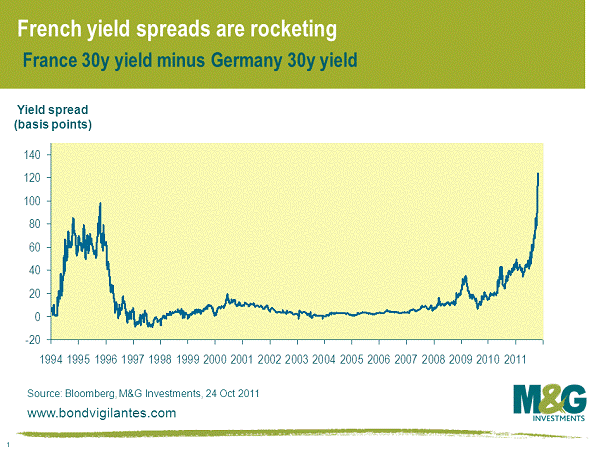

Interestingly as European leaders continue to meet, to meet, to meet, we note the exact opposite trend in European bonds, where prices are falling and yields are spiking across most sovereign markets. Here is a snap shot of french bond yields relative to german bond yields, France being one of the deemed stronger nations who are being asked to rescue Club-Med (Greece, Spain, Italy, Portugal, Ireland).

Increasing yields in France reflect concern that their bailout promises will threaten their AAA credit rating and is problematic since the plan of using the EFSF ( European Financial Stability Facility) assumes France will act as one of the needed AAA guarantors.

The bull market, in just about everything, that began in 1982 is over……it was fueled first by record high interest rates dropping from +/- 16% to near 0% today…..by incredible advances in technology and hence productivity…..and lately by reckless punters, corporate fraudsters, willfully blind regulators, and collusive puppet politicians…..if any one has any doubt please look at this chart for a simple historical perspective and what we can expect for many years yet….

http://stockcharts.com/freecharts/historical/djia1960.html

Grateful for Idiocy, a Pack of Lies, Financial Engineering, Legerdemain, and Trickery; Opposition Leader Rebukes Merkel’s Lies and Arrogance of Power

http://globaleconomicanalysis.blogspot.com/2011/10/grateful-for-idiocy-pack-of-lies.html

Dr. Copper

I just saw a piece on a very popular website that predicted copper is on the verge of a major multi year breakout. They show a chart which goes “all the way back” to 2006……gee whiz I guess this time it really is different. Of course the fellow writing the article looks all of about 25 years old so he must know, having lived through many business cycles.

I have included a different chart. It goes back 40 years. You will notice that the breakout of copper from a 35 year, very predictable trading range of $.50 to $ 1.50

was in 2006.

On Feb. 1 2006 Ben S. Bernanke was appointed Chairman of the Board of Governors of the Federal Reserve System.

“Helicopter Ben” began his grand “experiment”.

Probably just a coincidence…right.

Where do we go from here??

Well if the 25 something writer is correct and copper does break out and go on a multi year binge it will be a great time for the hyperinflationists and goldbugs but a catastophic nightmare for everyone else.

Place your bets and hang on it’s going to be a wild ride.

http://www.futuresbuzz.com/copperlt.html