For all those commentators who dive under the warm blanket of “decoupling” and “divergence” as reasons to keep hoping that stocks can do well in some countries while imploding in others. Here are a couple of charts that rip off the covers to leave “long-always” thoughts naked and exposed to the cold dawn of day.

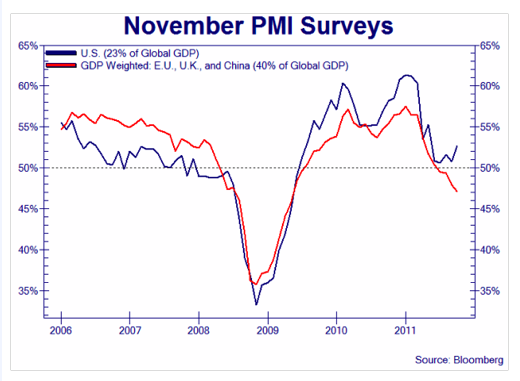

This one shows the nearly perfect correlation between the US Purchasing Managers Index (economic strength) and those of the EU, UK and China since 2006.

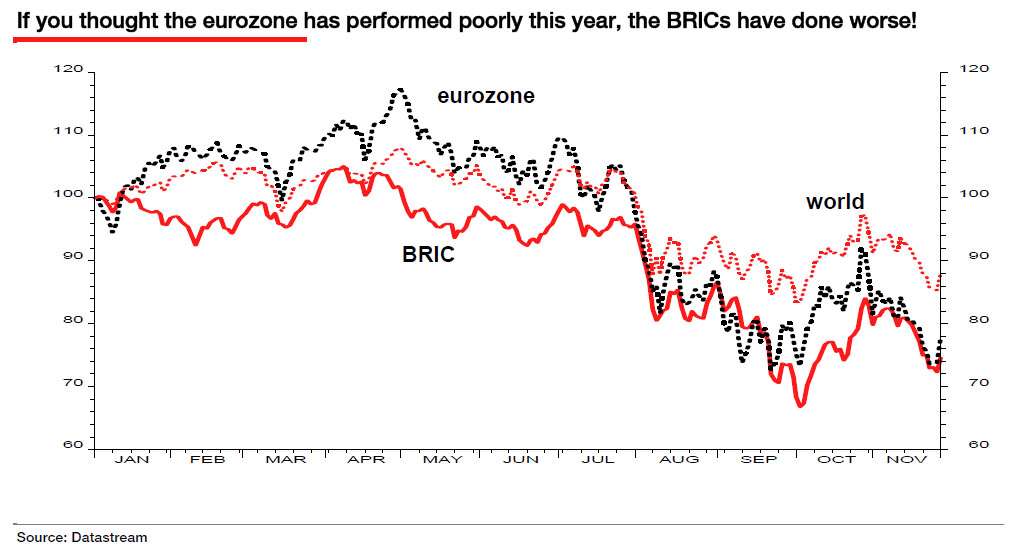

This one shows the unfortunate truth that year to date, the higher growth economies of Brazil, Russia, India and China (BRIC) have all suffered greater losses in their stock markets than the slow growth US and even the no growth Eurozone.

I understand that this reality flies in the face of the investment world’s main business model–that we never have to sell or wait in cash because there is always a bull market somewhere. But Dude, that model is killing your clients. Facts must be faced.

Central banks will print currency in this deflation, as they did during year 2000 and 2008. So the risk is hyper-inflation. Buy physical gold and silver to protect yourself.

Back in 07 I was shopping around for some one to look after my little stash and offer some sort of competent asset protection for my family in the event of my death. One of the well respected asset managers I spoke with was astounded at how much of my LNW was in cash. He said I was playing a very dangerous game not being more fully invested. He doesn’t call or send his newsletters any more.

Glitter ……. Gold and Silver bugs are about to get their heads handed to them on a sterling platter…..with all the madness yesterday and not withstanding the idiot trade bidding up the mining shares in a mindless frenzy gold could barely muster a $30.00 gain to top at major resistance……I sold 1/2 my holdings and now am down to 5% of assets and looking to protect that.

The only commodity group to hold today is one that actually has a use, is needed by everyone and is not replaceable any time soon…..Got Energy?

I read one time where someone said that if you can’t make money with half your money, you will not make more with all of it.