People frequently write to me expressing a fatalistic idea that they have no choice but to be used and abused by the financial services sector because “What is a little guy to do? What choice do we have?” Much to the contrary, there are many things people of all sizes can do to help themselves.

It starts with the idea of self-reliance and self-control. It means saving a significant portion of our income each year. It means controlling spending even during boom times so that we have money to soften the inevitable slow times. It means paying off our homes as soon as possible (even if the interest is tax deductible), because it is simply better for our peace and financial security to live in a debt free home. It means avoiding personal debt. It means operating our businesses with as little credit as possible. It means not buying consumption goods because we can “afford” the monthly payment if we do not actually have the money to buy the item upfront. It means understanding that there is a world of difference between between “having income” and “having money”. Most spend as if they have the latter when in fact they only have the former, and if anything happens to their employment income, they find themselves unexpectedly in financial distress. It means accepting that no financial adviser, mutual fund or stock is going to make us financially secure. Only we can do that for ourselves through our choices and behavior.

As we build our savings nest egg, the focus must be on keeping the bulk of our capital safe and liquid. Investment risk that we chose to take must be carefully controlled, monitored and calculated based on rational probability assessments not perpetual blind hope. This includes not making any investment unless we have damage control rules in place from the outset.

Over the past 15 years as much of the world became under-saved and credit-addicted, individuals and countries came to depend on the wizards of finance for their survival. This is a huge mistake. The lessons of the credit crisis and our ongoing challenges remind that risk sellers have their own profits as their primary motivation. Their agenda is often directly in opposition to the best interests of ourselves and our family.

No one controls the future. Life is full of risk. The only control we have are our daily habits and decisions based on the facts and probabilities we are presented with. Living with financial discipline (debt free) and self-reliance is the best way to have a say in our outcomes.

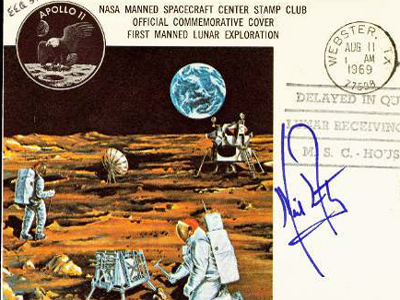

In this vein, I found this story about the Apollo 11 astronauts inspiring. In the early days of the Apollo program – an astronaut’s mission into space was literally uninsurable.

“Back then astronaut captains made about $17,000 a year, NPR reports and a life insurance policy for Neil Armstrong would have run about $50,000 a year, or more than $300,000 in 2012 dollars…

So about a month before they were set to go to the moon, Neil Armstrong, Michael Collins, and Buzz Aldrin were locked into a Plexiglas room together and got busy providing for their families the only way they could — they signed hundreds of autographs.

In what would become a common practice, the guys signed their names on envelopes emblazoned with various space-related images. The ‘covers’ would, of course, become intensely valuable should the trio perish on the mission. They’re now often referred to as ” Apollo Insurance Covers.”

And to ensure the covers would hold maximum value, the crew put stamps on them, and sent them in a package to a friend, who dumped them all in the mail so they would be postmarked July 16, 1969 — the day of the mission’s success — or its failure.

Fortunately, the trip went off without a hitch and all three men went on to live long, healthy lives and all remained alive until Neil Armstrong’s death a few days ago.

The covers are still around, and not too hard to find. In 2011, Collectors Weekly pegged their average value at around $5,000.”

Brilliant. See: Neil Armstrong couldn’t afford life insurance.

Thank you both for the sobering thoughts and charts. Feel like a stock market junkie in need of AA. Your blog posts are my AA meetings. JW, Langley BC

Pingback: Weekly News Links: | The Retiring Boomer™