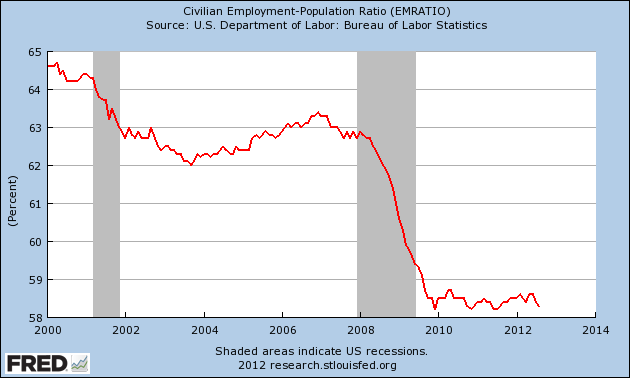

Yesterday Fed Chair Bernanke stated that the Fed would continue to offer quantitative easing until the unemployment rate comes down. As shown in the chart below that there is no evidence that any of their mammoth efforts to date (QE1, 2, Twist) have had any positive effect on employment. There is no reason to expect that this next tranche of recycled bonds will have an effect where previous trillions have not.

Follow

____________________________

____________________________

Danielle’s Book

Media Reviews

“An explosive critique about the investment industry: provocative and well worth reading.”

Financial Post“Juggling Dynamite, #1 pick for best new books about money and markets.”

Money Sense“Park manages to not only explain finances well for the average person, she also manages to entertain and educate while cutting through the clutter of information she knows every investor faces.”

Toronto SunSubscribe

This Month

Archives

Log In

There are a number of opinions on why Central Bankster In Chief Ben Bernanke initiated QE Forever yesterday.

One cited reason is to essentially destroy the value of the US dollar. Now, if one understands that the US dollar/Treasury system has historically been a huge source of power for the United States, then one might not give this argument much credence. However, if one also understands that, as far as governments are concerned, it is the RELATIVE value of their currency that matters most.

So, if the US dollar were to lose its REAL value (as measured against gold and commodities) but reatain its relative value against other currencies, such as the euro, that’s OK as far as they are concerned. Notice how Bernanke and Draghi are working together to bring down both the euro and the dollar in a coordinated manner. Then the smaller players just follow suit or risk destroying their exports. The only thing that makes this whol fiasco possible is the lack of a viable alternative reserver currency outside the dollar and euro.

Bernanke is using employment as an excuse to devalue the dollar and inflate asset prices. IMO, this is not about employment. The ultimate reason for QE forever is to appropriate as much actual wealth from savers as possible in order to create a managed decline that is the ultimate result of decades of living beyond the means. If the wealth can be taken from actual economic growth, that would be preferrable, but if their is not enough economic growth, then stealing from savings will do for now. Until the entire system just implodes.

What happened yesterday is Bernanke essentially threw in the towel and showed his hand. Or at least he admitted what cards he was holding. Everyone already knew what he was holding, he just made it official by laying his cards on the table and initiating the final act in a decades long era of finanical and monetary insanity.

Prepare. And pray.