With the rally in US stocks back toward 2007 highs the past 3 months, many may assume that Canadian stocks have also recouped their 2008-09 losses. But that would be wrong. The Canadian TSX composite at 12,700 today remains 16% below the cycle peak it reached in June 2008 (before it fell 50% to March 2009) and 10% below the rebound cyclical peak reached in March 2011.

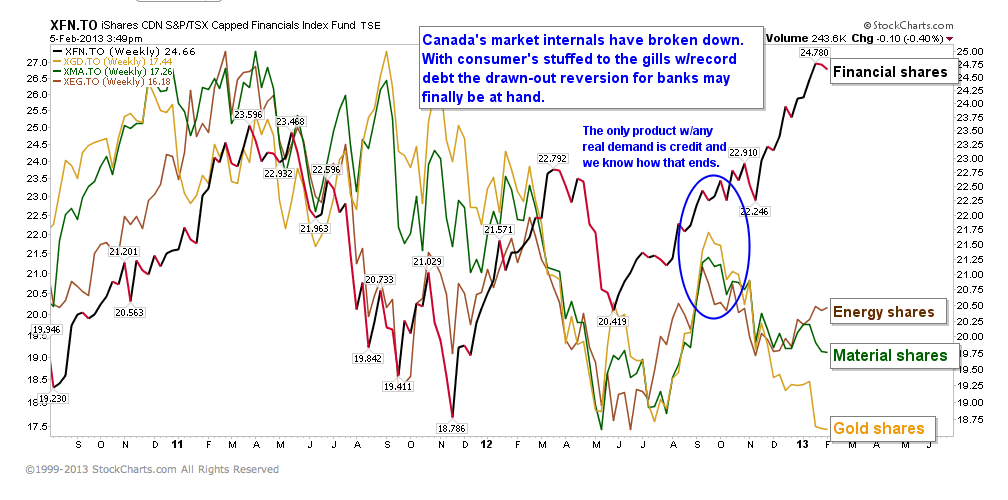

Since March 2011, the Canadian market remains in a cyclical contraction within the broader secular bear for stocks that began from lofty valuation peaks in 2000. Moreover, as captured in the chart below, a dramatic rebound in Canadian financial shares over the past year, has masked some of the ongoing secular weakness in the engine sectors of the broader Canadian economy (and our stock market) as world demand for our rocks and trees shifts down following the global consumer credit bubble. With the Canadian realty market only now beginning to contract in earnest and Canadians back to borrowing as consumer debt hits new highs, Canadian financials look vulnerable and likely to under-perform lofty expectations and valuations from here. Once this sector cracks (as it did in both the 2002 and 2008 bear markets, losing 50% each time), we are likely to see an attractive re-entry point for Canadian dividend paying stocks. Until then, price risk remains extreme. Just as seniors and other unsuspecting folks are being set up for hard lessons they cannot afford, once more…sad.

Source: Cory Venable, CMT, Venable Park Investment Counsel Inc.

Danielle, do you think the Canadian stock markets could ‘decouple’ from the US? Historically, the correlation has been very tight. But if the Canadian economy begins to really diversify out of the US and more into Asia, perhaps that historical correlation could break down? Thoughts?

No we often move at a lag or a lead to the US cycle, but we have never decoupled. I don’t think its a realistic expectation.

Thanks

If the stock market is in for a major correction, does nothing change as far as stocks go except for the fact that they will just depreciate in price? At the bottom of the correction if there is one, do you then just hand pick your favorites, or is there a method of chosing stock? Since the stock market is a psychological emotional roller coaster, where is common sense in investing?

Disability claims/fraud at record levels now

http://cnsnews.com/news/article/8830026-americans-disability-hits-new-record-192nd-straight-month

yes you need to have a plan, method/template already devised before the correction so that you know what and how much of sectors, indices or individual companies you wish to add to which accounts. You need a buy point and you need to define a sell threshold in case price breaks down further than you expected.

Danielle

Can you share with us your buy points for the coming correction you are predicting. At what level would you be a buyer of the S&P?

Danielle, as well as the above question, where do you see the tsx falling? Will you please post on your blog when you feel the time is right to buy,

for all your loyal followers….much appreciation for all that you do!!