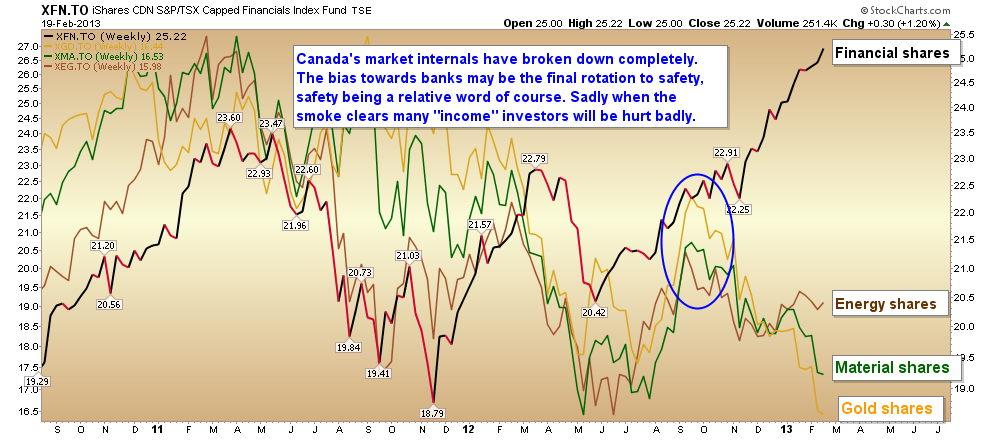

Top line gains for the broad Canadian stock market over the past year have been driven by the financial sector as low rates have continued to drive yield-desperate capital into over-valued bank shares. Unfortunately as reflected in the chart update below, the real economy and the sectors that drive it like energy, materials, and Canadian housing are all in the midst of an ongoing downturn. Canadian banks have never been impervious to previous economic downturns, and with slowing global demand and debt-strapped Canadian consumers, financials seem particularly vulnerable this time.

Chart source: Cory Venable, CMT, Venable Park Investment Counsel Inc.

It is the RRSP season. Savers are targeted to grind the markets higher in February, possibly through March and most part of April. Thank you both again for sharing. Langley, B.C.