At the Canadian stock market’s last cycle peak in the summer of 2008, it was the bubbling commodity and resource sectors that presented the greatest over-valuations and thus price risk within the topping TSX. After collapsing 30 to 70% to date, mining, materials and energy companies are continuing to pay back for their credit bubble euphoria, trading down with global demand and taking the closely tied Canadian dollar along for the ride.

The broader Canadian stock market also lost half of its value into 2009, and has only managed to recover 79% of that loss over the 4 years into 2013. But much of that recovery was courtesy of the greatly over loved Canadian financial sector. First it was the international praise that the Canadian banks had fared better through the 2008 crisis than most (thanks to less leverage on their balance sheets going into the crisis). Then it was euphoria about soaring bank profits as Canadians borrowed their brains out and the Canadian government shoveled hundreds of billions of taxpayer obligations behind bank mortgage products through the Canada Mortgage and Housing Corp. And lastly there was the global branding coup as our Bank of Canada head Mark Carney was hired by the Brits to show them how its done.

On all of this happy news, the Canadian financial sector (XFN) rocketed up 41% in the past 18 months, 29% in just the past year alone, as income-desperate folks herded toward the promise of “conservative, dividend-paying stocks”. It has been a meteoric rise to be sure, leaving most investors, advisers and fund managers today heavily loaded in this now extremely over-priced sector.

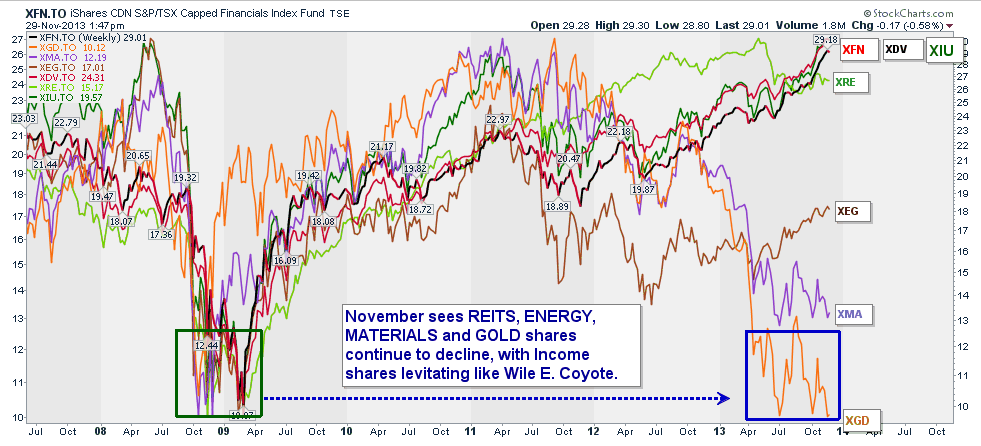

Even broad market investors who may not realize it, are up to their uxters in the Canadian financial sector today with the TSX 60 Index market cap now more than 37% concentrated in financials, compared with a 23% weight in energy, 10.8% in materials and just 7.4% in industrials. This chart gives a recent big picture view on the various sector prices, showing the “feeder fish” financials at an all time record high at top, and the meat and potato sectors of the Canadian economy (energy, materials, mining) at or moving toward their previous 2009 cycle lows (at bottom).

Source: Cory Venable, CMT, Venable Park Investment Counsel Inc.

Capitalizing on recent price gains, the broker/dealers are doing their usual scrambling to roll out all manner of new funds, split shares, ETFs and structured products focused on the “hot” financial sector. Just as they did in 2000 and 2007 (when financial shares were last at cycle peaks, and soon to drop 50%).

At the same time Canadian consumers are tapped out on debt and loan demand has softened. Canadian businesses are consolidating and the IMF is recommending that the Canadian government rethink its extraordinary backing of the Canadian banks and mortgages through CMHC and start looking at ways to encourage meaningful business investment and development rather than just the non-productive housing sector.

This week the big 6 Canadian banks began reporting their latest quarterly earnings. While profits are huge, the outlooks have been disappointing and the stocks have been selling off. Priced for perfection and then some, Canadian financials are today the Achilles heel of the Canadian stock market. This recent chart of Bank of Montreal gives a sense of the price risk now confronting holders. Look out below.

Chart source: Cory Venable, CMT, Venable Park Investment Counsel Inc.