We know that the US economy ‘officially’ contracted at an annual rate of 2.1% in Q1 before rebounding on inventory build(restocking not sales) in Q2.

We also now have official confirmation that as of Q2, Italy is back in recession, the Japanese and German economies contracted and France was stagnant with zero growth.

Portugal’s price index slumped 0.7% in July. Spain saw the steepest slide in consumer prices in five years. See stagnation in the Eurozone here. Brazil is struggling too, with revised 2014 consensus forecasts recently down to 1.44% versus the 3% forecast last summer.

In the first half of 2014, Russia’s growth slumped to an annualized rate of .85%, the slowest rate in five quarters, and is expected to weaken further in the second half of the year. Together these economies represent more than 60% of global output as shown here.

Bulls peg hopes on a continuation of higher growth in the UK, China and India. But with high household debt and weak wage growth in the UK as well as weak domestic demand in China and India, these countries are in need of stronger external demand to support their growth. That is unlikely to materialize over at least the next year or so.

Bulls peg hopes on a continuation of higher growth in the UK, China and India. But with high household debt and weak wage growth in the UK as well as weak domestic demand in China and India, these countries are in need of stronger external demand to support their growth. That is unlikely to materialize over at least the next year or so.

Despite the hype and hope of central bank monetary experiments, the global economy is slowing at a an accelerated pace coming into the second half of 2014. Economic bell weather copper concurs, having fallen more than 32% since 2011 and 7% year to date. Government bond yields are also deflating with global growth: the 10 year German bond yield today moved below 1% as the US 10 year yield is back at 2.4% down from 3% 7 months ago. And yet, US mortgage applications–normally expected to surge as rates fall–have not picked up, now at levels last seen in 2000 (shown below). The golden goose of lower rates seems to have finally exhausted its ability to force increased consumption.

Chart source: www.zerohedge.com

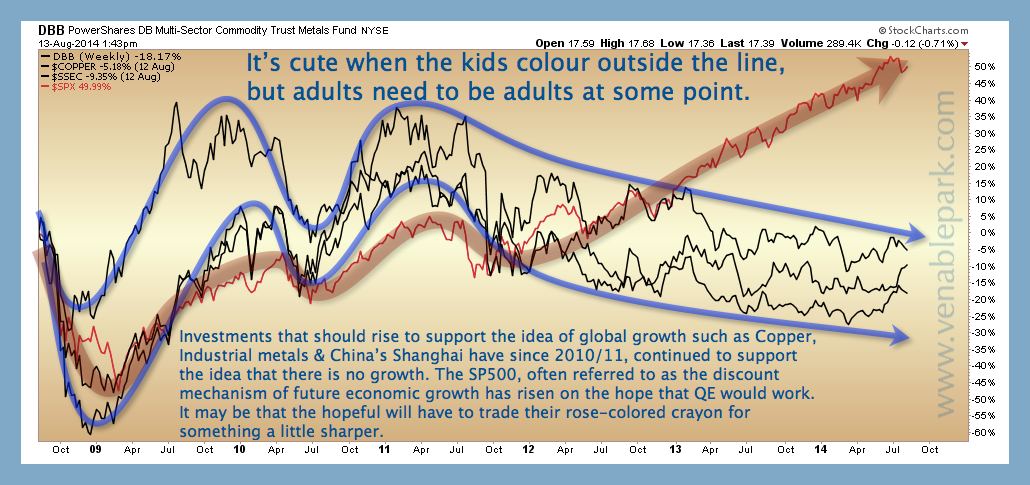

All that remains is for the algo-driven S&P 500 to admit facts and fall back down to reconnect with sales growth here on planet earth. This chart showing the extreme overshoot of large cap North American stocks (here the S&P 500 in red) on QE hopes the past 2 years, as compared with other growth barometers like industrial metals and Chinese stocks, gives a sense of the price risk facing present stock holders. As well as the opportunity coming for those who can design themselves now to be ready.