Robert Shiller, Yale University professor of economics, explains his “Titianic” economic theory for why the stock, bond and housing markets all look pricey today. Here is a direct video link.

He points out that historically “there are always special factors” to argue why ‘this time is different’ and price to earnings ratios should remain permanently higher than their 144 year average. (Until they mean revert way below average once more of course)

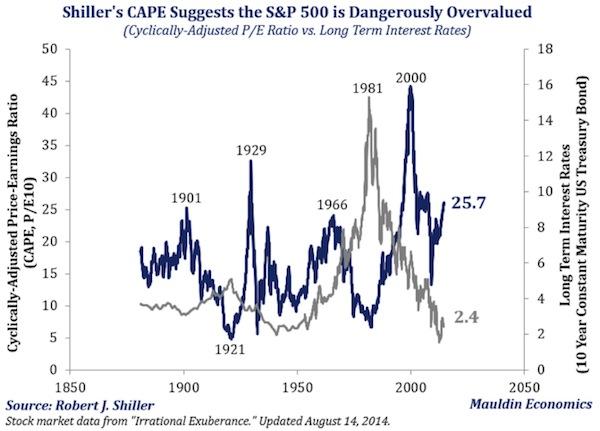

“Stocks, bonds, real estate. How can it be that everything is expensive?” QE-seats on the Titanic everyone? Your friendly broker/dealer/financial advisers are all just itching to help you pick your seat. Step on up! Maybe you can enjoy the ride a little longer before all the passengers plunge below the waves. PE in blue below, interest rates in grey.