Long bond yields are headed south pretty much all around the world today. Whether it be consumers and businesses pulling in on travel, trade and spending because of Ebola, ongoing conflict in the Ukraine, or the middle east, the world’s major economies were teetering on economic contraction in the first half of 2014, and the second half is now looking weaker still. The Fed needing to raise rates soon to pull in accelerating growth and inflation? In their dreams.

The US bond curve has flattened to just 1.50% of additional yield in 30 year treasuries over 5 year treasuries. This is the flattest the curve has been since January 2009 when the world was last in global recession and suggests that the bond market sees slower growth ahead. Normally, this would also mean that central banks would be expected to cut short rates as the economy slows. This time, of course, they are already at zero. There is no cavalry left to come. Stocks have yet to comprehend.

The chart below of the 30 year treasury yield shows that year to date, there has been a decisive break down of the rising yield trend that had been in play since Q’Ever spurred rabid accelerated growth hopes in late 2012.

But wait, Mad Mario says he’ll keep rates lower for longer in the EU even if the US Fed were to start hiking in 2015…but then real rates have already been negative for the past several years as shown in his chart here.

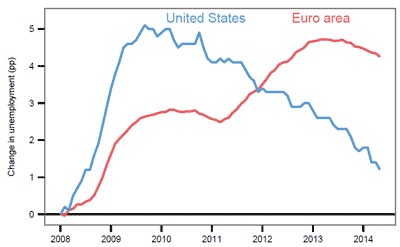

And still unemployment has soared since 2008 in the Eurozone as shown here.

How does one push a gas pedal that is already fully down, through the floor-board and out the other side? Not to worry though, Mario says he’s “confident” stimulants are working. Any day now.