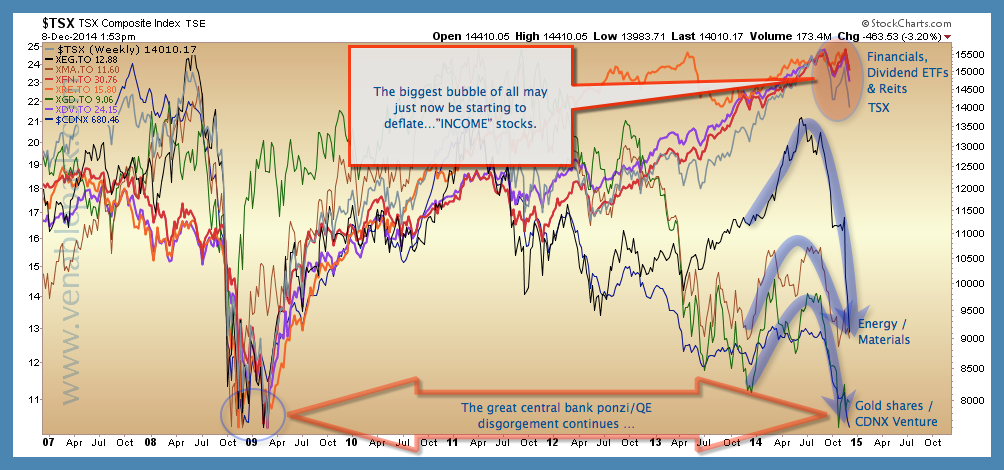

Points of reference to ponder: the energy (21.6% weight) and finance (36% weight) sectors account for a combined 57% of the broad market TSX composite today. Even with significant declines since June, the energy sector index still has a further 24%, and the financial sector index some 67% (which includes 90% of income trusts/REITS), of downside before returning to their 2009 cycle lows (see top lines on far right of chart below). If you think that seems impossible, then you don’t appreciate the range bound dynamics that create market cycles within secular bears.

Having these 2 dominant sectors recouple with other key economic sectors that have already retraced near their 2009 lows, would knock the broad market TSX 29% lower –so from current 14000 to the 9900 range. And that’s without any commensurate declines in other so called ‘conservative’ sectors like health care, utilities, consumer discretionary, telecom etc. When likely weakness in these other areas is added, a retest of the 8000 area becomes quite plausible for the TSX before this full cycle completes.

A similar magnitude decline for the correlated S&P 500 also makes cyclical sense–so greater than a 50% decline from present levels. Sectors and broad markets often lag one another, but historically ‘decoupling’ is a finance myth.

A similar magnitude decline for the correlated S&P 500 also makes cyclical sense–so greater than a 50% decline from present levels. Sectors and broad markets often lag one another, but historically ‘decoupling’ is a finance myth.