The trouble with being an equity investor today is that valuations make no sense. For a current update see: Market action suggests abrupt slowing in global economic activity. Here is the bottom line:

“With median valuations for the average stock higher now than in 2000 on the basis of price/revenue, price/earnings, and enterprise-value to EBITDA; with numerous historically reliable valuation measures more than double their pre-bubble historical norms; and with the S&P 500 now beyond the peak valuations of every market cycle on record (including 1929) except for the final quarters surrounding the 2000 bubble, understand that stocks are no longer an investment but a speculation.”

The facts are what they are and can’t be changed by hope or prayers. So those buying and holding equities at current levels are doing so on some thesis over than ‘investing’. Perhaps they believe that central bank interventions will succeed in perpetually maintaining animal spirits and lofty prices. Perhaps they believe that big banks and HFT trading will maintain stocks at ‘permanently high plateaus’.

Whatever the thinking to justify participation, the activity is clearly gambling–betting on the luck of a win–not investing in assets that are valued for longer-term success.

Of course, it is widely known that– fleeting lucky runs notwithstanding–gambling is a losing game that eventually ends in capital destruction. But most gambling in equity markets today, are neither prepared nor expecting to lose money. This is a multi-trillion dollar problem of mismatched speculative assets with real world expenses and liabilities that need to be paid. This game cannot end well.

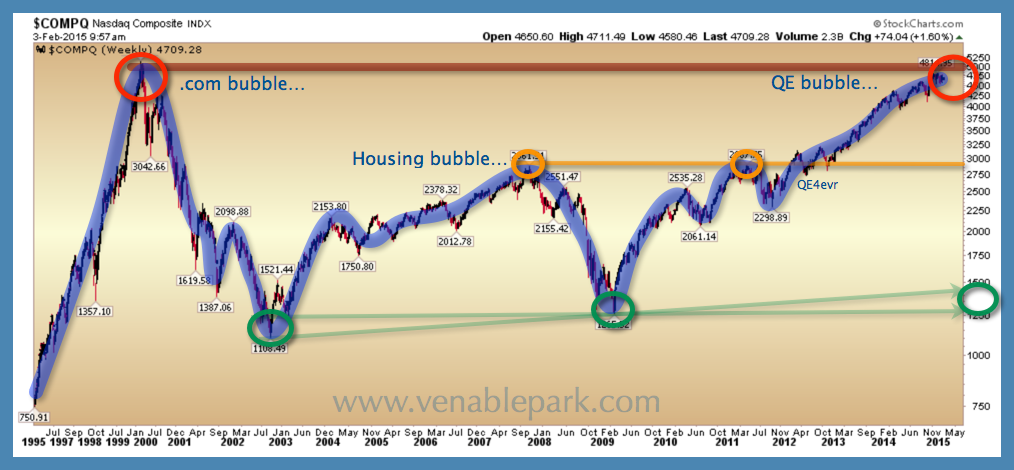

This 15 year chart of the NASDAQ composite since 2000, offers perspective on the rarefied bubble-highs today achieved for the second time in market history. Second time a charm or a nightmare? Depends on whether one is betting on permanent highs or mean reversion. We know which one the odds favour…