Unfortunately we already have the bust part of their handiwork…pretty much worldwide.

ECB head Mario Draghi is your typical ex-Goldman, deluded banker, consumed by a God complex that prevents him from admitting the failed policies and mistakes of he and his colleagues. Indeed convinced of their own brilliance, he promises to perpetrate more of the same, so long as he is allowed to stay in the seat.

Today he acknowledged that 8 years of monetary magic and counting and inflation rates in the EU are presently zero. But not to fear. He says he is confident that his 2 percent annual inflation target is attainable any day now. Here is the cheat sheet on the latest QE plan, announced today. See ECB ready to buy bonds, signals inflation goal in reach.

Here are the key facts:

• Purchases under the program will start on March 9.

Purchases will total €60 billion per month.

• The ECB will purchase debt with negative yields, so long as those yields are not below the ECB deposit rate at time of purchase. The ECB deposit rate is currently -0.2%.

• If a Euro-Area central bank cannot purchase sufficient marketable debt instruments to fulfill its allocation, the ECB will allow substitute purchases. This substitute purchases rule should enable the ECB to fill its €60 billion target each month.

• The ECB will not buy more than 25% share of any one issue in order to avoid it having a blocking majority in case of any debt restructuring.

• The ECB will only buy in the secondary market.

• The ECB will purchase debt with remaining maturity between 2 and 30 years only.

• The ECB provided a list of the international and supernational institutions and agencies it would purchase the debt of

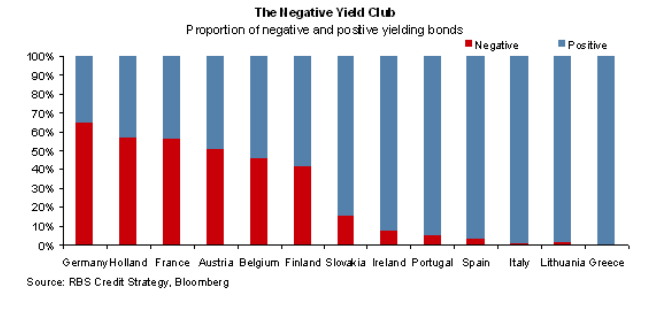

Note that the ECB said they can buy bonds with slightly negative yields of no more than the ECB deposit rate–currently -0.2%. But in truth the club of negative yielding sovereign issuers is spreading and growing more deeply inverted and negative by the day as pension funds and other conservative capital is left chasing whatever scraps of relative stability are left in a world now full of broken investment options. Such a mess. See: This is nuts, where have all the bonds gone.