Automated trading machines incited by central bank jawboning the world over, have helped to push global stock markets to the highest valuations since March 2000 and October 1929. Meanwhile earnings and sales are plunging…from a Q1 analyst consensus for S&P earnings growth of 4% in January, EPS expectations have fallen 9%, now at -4%.

The next wave of the financial crisis lies ahead…

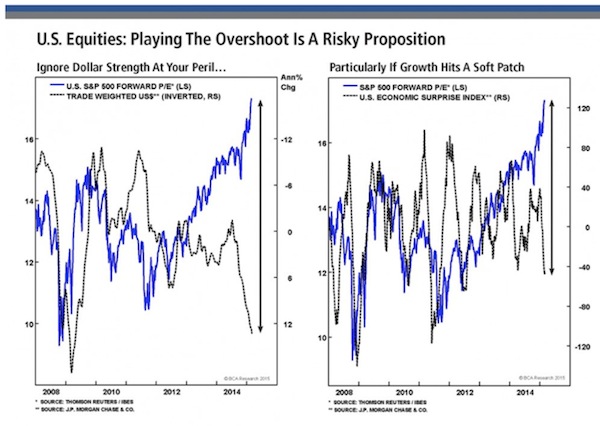

U.S. markets struggled in the first quarter as investors worry over the impact of falling oil prices on overall earnings and the effect of a strong dollar on multinational companies, whose products are more expensive in foreign markets when the greenback firms up. Here is a direct video link.

Also see former Fed Governor Kevin Warsh (now at the Hoover Institution) on CNBC this morning.

“The markets think they have Yellen’s number,” that she will never allow markets to go down, Warsh warns “that is a very dangerous development.” Here is a direct video link.