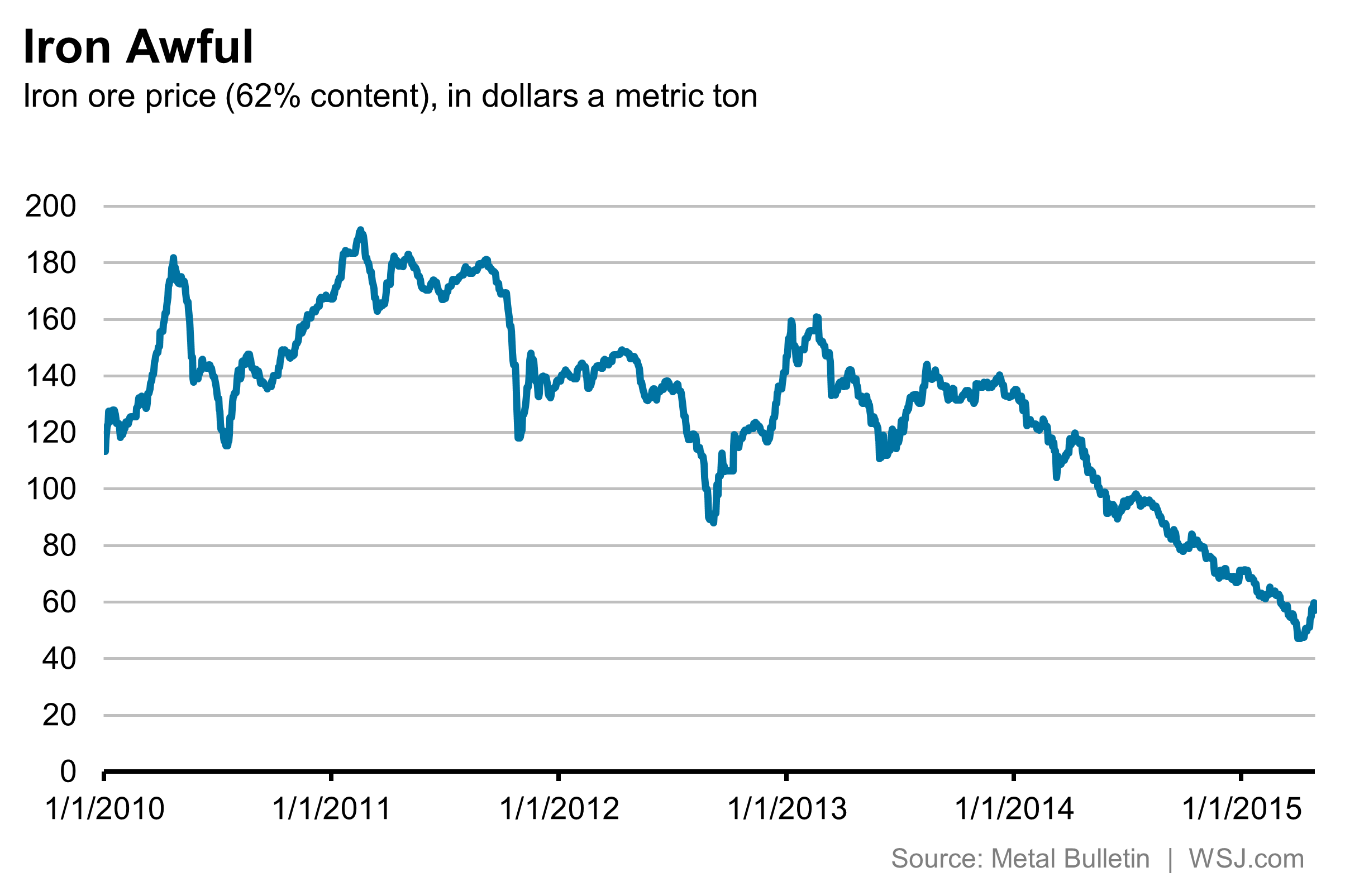

Massive credit-bubble fueled, multi-year booms in capacity, production and inventory don’t clear in a few months, especially when suppliers continue to increase output as demand falls. This chart of iron ore gives its April rebound some context.

See, Iron Ore heads towards its next cliff. Oil bulls should take note:

“One of the crueler aspects of a hangover is how you can occasionally fool yourself into thinking you have recovered even though many hours of crushing misery remain. The 2.1 billion-metric-tons-a-year iron-ore market is actually dealing with two related hangovers.

First is the slowdown in China, the economy that consumes about 60% of iron ore and is coming off a stimulus-fueled construction boom. Second is the massive expansion in supply predicated on China’s fascination with building never abating.

From the start of 2011 to the beginning of this month, benchmark iron-ore prices fell from almost $200 a metric ton to less than $50. Yet for much of April, iron ore staged a rally. By the time Cliffs Natural Resources beat expectations with quarterly results late Tuesday, prices had jumped 27% from their low point.

This relief is ephemeral, as Wednesday’s 4.6% drop in iron-ore prices emphasizes. Optimism had sprung, in part, from a 5% jump in Chinese crude steel production in the first 10 days of April. That, coming alongside signs of monetary easing by Beijing, stoked hopes of better demand growth. But structural headwinds in the form of China’s desire to pivot away from fixed-asset investment and need to deal with bad debt remain.”

Even producers who have managed to engineer earnings in recent quarters have talked about the need for production cuts across the supply chain. But no one is wanting to actually implement cuts when most are desperate for cash flow. And so the global glut mounts: “The only thing worse than a hangover is relying on a fellow sufferer to help fix it.”