The charade of Chinese publicly traded markets reveals the folly of central planners believing they can control and sustain prices where they want them. At best they may buy some time to extend and pretend. But in the end they only waste good money after bad, as over-juiced asset prices resume the path of least resistance back to levels that reflect the financial reality of companies and economies.

The charade of Chinese publicly traded markets reveals the folly of central planners believing they can control and sustain prices where they want them. At best they may buy some time to extend and pretend. But in the end they only waste good money after bad, as over-juiced asset prices resume the path of least resistance back to levels that reflect the financial reality of companies and economies.

When government interveners and other levered speculators are the only ones willing to buy assets you know that the mirage of prior gains is not long for this world.

China’s share market rallied on Friday, buoyed by the news of massive support to the tune of $210bn from the country’s banks. Michael Mackenzie, markets editor, says China may face a rather long wait until becoming a heavy hitter in global indices. Here is a direct video link.

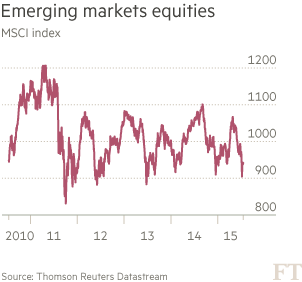

Other emerging markets have been even less successful in keeping up QE appearances of growth and optimis m. Over the past 5 years as financial strength has weakened, emerging markets have swung about in wild waves of speculative fury, accomplishing nothing but losses (chart on left). See: China’s MSCI hopes soured by stock rout.

m. Over the past 5 years as financial strength has weakened, emerging markets have swung about in wild waves of speculative fury, accomplishing nothing but losses (chart on left). See: China’s MSCI hopes soured by stock rout.

Other global markets still banking on the power of the US Fed and the ECB central riggers to sustain the unsustainable, would do well to take note…