Market cycles during secular bear periods are repeatedly savage. Those who buy and ride valuations beyond reason on the upside repeatedly pay with sweat, tears and capital losses on the downside. Once markets move through their natural course of mean reverting prior exuberance, previously confident participants typically panic and liquidate, locking in permanent losses. But even those brave and patient believers who are able to resist selling and hold on through the cyclical declines are rewarded with lost years holding and hoping to make back capital losses. Financial types assure us this is progress. In truth it is the opposite.

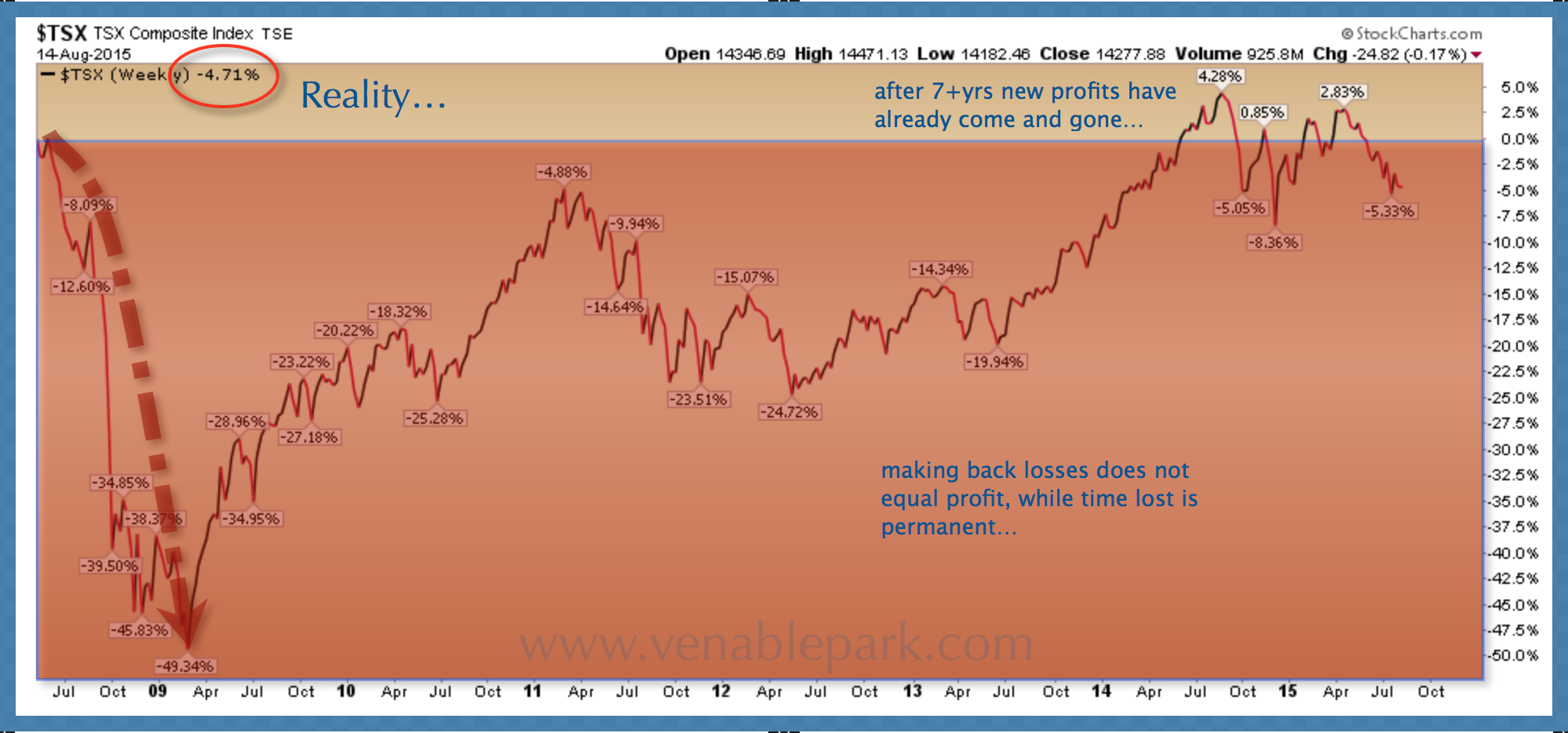

The chart below shows the drawdowns, rallies, and negative capital progress for those holding the broad Canadian stock market (TSX composite) over the past 7 years since the summer of 2008. Of course when you add in the notional 3% annual dividends, the annual return becomes modestly positive over this holding period. That is if holders were not paying any investment fees or withdrawing any income from the portfolio.

Sure, in the heavily marketed, make-believe world of theoretical investment returns, no one ever panics and sells near market lows, or adds life savings near market highs, or pays any fees, or withdraws any income, and they always have cash and nerve to buy more at market bottoms–yep, in theory there is nothing to detract from the magic of compound growth assumptions. Sure in that world–the one laid out in finance marketing materials–investing our savings in capital markets is a no-brainer.

One can imagine that few will be content to ‘hold’ their equity exposure as the bear market deflates market prices from current levels and possibly back towards the 2009 lows–or even lower. The resource heavy Canadian Venture Index has already broken below the 2008 Great Recession lows as shown here. No reprieve is yet in sight.