All the financial hubris, reckless leverage/derivatives and European trade imbalances of the past decade are reflected in the chart of Germany’s late great Deutsche Bank. From $125 in May 2007, the stock lost 85% of its value to bounce at $19.30 in January 2009. Since then it has fallen a further 25%, to $14.54 today. In recent months, its CEO has been warning that the ECB’s reckless rate policies are killing Deutsche’s viability. After all, his stock-based compensation is getting crushed here, so he really is frustrated now.

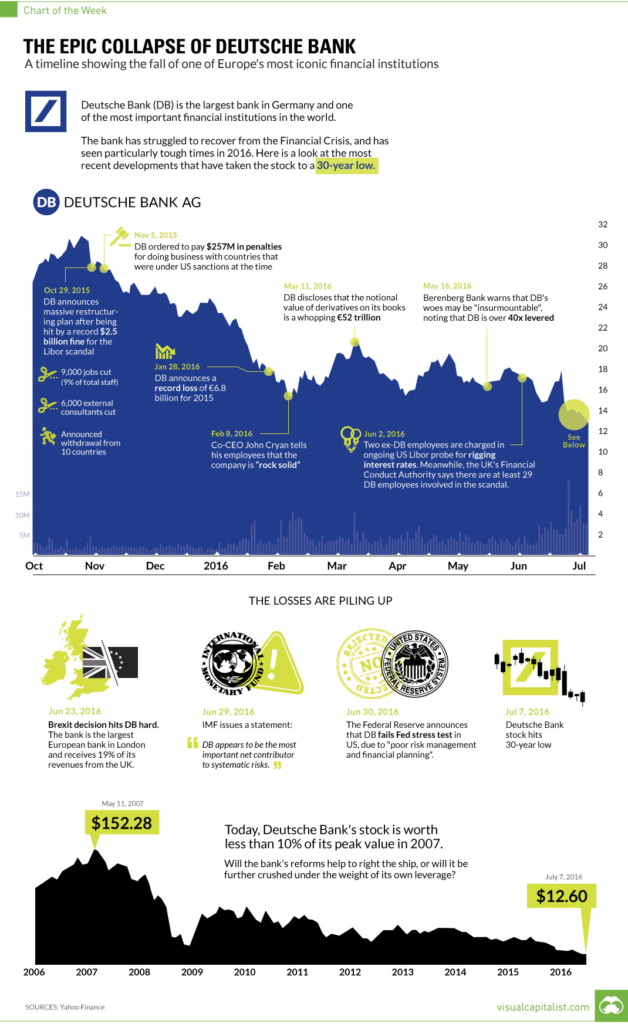

This firm is an integral counter-party to derivative contracts that link all the largest global banks. This is a big problem. And it’s not getting better, even if delirious markets and participants are presently whistling past the grave yard of other major institutions that have collapsed before it. See The epic collapse of Deutche Bank:

If the deaths of Lehman Brothers and Bear Stearns were quick and painless, the coming demise of Deutsche Bank has been long, drawn out, and painful…