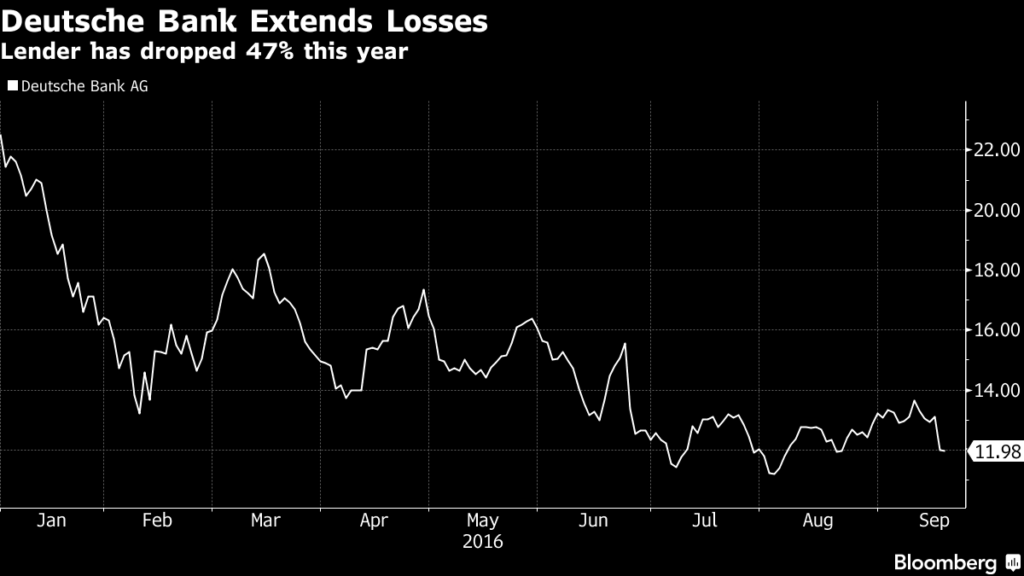

After years of reckless management, over-leverage, regulatory infractions and illegal activities, Deutsche Bank (one of the worlds most systemically interconnected banks) is falling into a capital death spiral reminiscent of Lehman Bros. and Bear Stearns in 2008. The shares are down more than 47% this year so far. See: Deutsche Bank extends losses as analysts see capital threats.

Deutsche Bank AG extended losses as analysts signaled that legal costs may force the German lender to raise capital even if it succeeds in whittling down the $14 billion bill over its mortgage-backed securities business…

Germany’s biggest bank would be “significantly under-capitalized” even assuming enough provisions to cover an eventual settlement with the U.S. Justice Department, Andrew Lim, an analyst at Societe Generale SA, said in a note to investors Monday. Any settlement above 5.4 billion euros ($6 billion) would imply a capital increase is needed just to pay the fine, he wrote. Here is a direct video link.

Of course Deutsche is not the only bank now struggling in the zero and negative yield world of central bank design. In fact thanks to derivatives and counter-party agreements, Deutsche is today a veritable hub in the global finance cartel wheel. Financial stress is highly contagious.

Of course Deutsche is not the only bank now struggling in the zero and negative yield world of central bank design. In fact thanks to derivatives and counter-party agreements, Deutsche is today a veritable hub in the global finance cartel wheel. Financial stress is highly contagious.

Policies that were rolled out to rescue global investment banks and their bond holders from the disastrous fruits of bad business models in 2008, have now come full circle to evaporate viability. Mark to fantasy accounting and regulatory capture is no longer proving sufficient to offset the weight of fines, legal fees and crashing margins.

You know what they say about Karma, right?

This just in: Deutsche Bank planning to raise capital by securitizing 5.5 billion of corporate loans in a synthetic collateralized loan obligation, or CLO to transfer the risk of losses to investors (recall this stuff from the 2001 ENRON collapse or the 2008 “big short”)? Same dog, same tricks. Solvency fix or desperate stop-gap measure, what do you think?