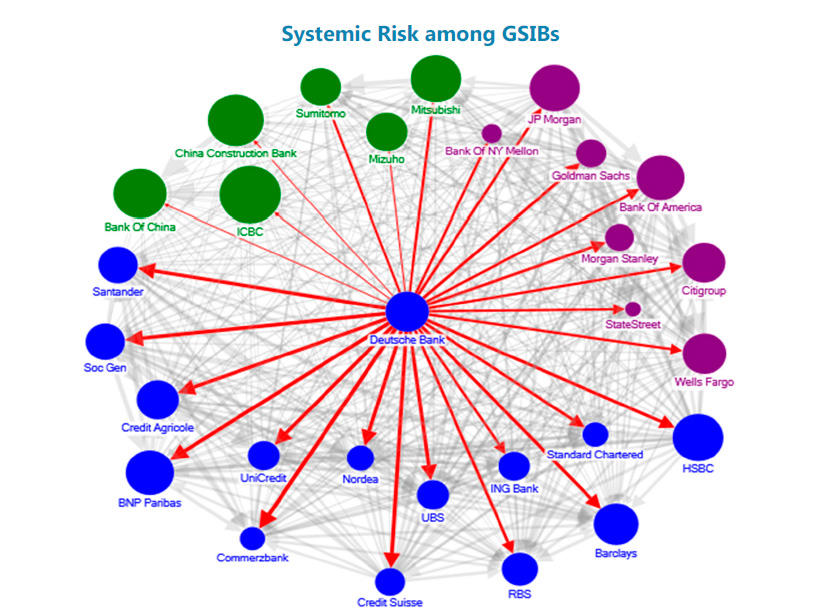

As we have written earlier, Deutsche Bank is a canary in the ongoing global financial crisis. Its culture and management have blown up a $2 trillion balance sheet with reckless risk taking, illegal activities and suicidal-leverage. Now they are blaming a $14 billion fine being demanded to settle their role in mortgage fraud as unreasonable and want Germany to bail them out. So far Merkel’s government has said ‘nein’ as they face low popular support and a desire to distance themselves from bankers heading into next year’s election. But then there is the inter-connectivity between Deutsche and the other too-big-too-exist global banks as captured in this chart.

Will personal prosecution, compensation clawbacks and job losses follow for the directing executives this time? It certainly needs to, might as well start now.