In the week after the Trump ‘shock’, North American old economy stocks have rallied and bonds have fallen. But do market participants actually believe that promised fiscal stimulus will be so effective as to sustain rising inflation and profit growth amid today’s record debt, aging demographics and stagnant wage backdrop? As “amazing”, “smart” and “incredible” as Mr. Trump has declared himself to be, the mathematical challenges here are bigger and more formidable than any one figurehead or political party.

As Hoisington Investment Management noted this week, tax cuts and infrastructure spending even if they pass (fiscal conservatives notwithstanding), will take a considerable amount of time to work through the economy and efficacy will depend in large degree on the continuation of favorable monetary conditions and rising money velocity. Seven years since the last recession, these are highly improbable assumptions.

Even the much bigger Reagan tax cuts of the early 1980’s, that packed a much higher multiplier effect because Federal debt was then relatively low, and interest rates were starting from record highs that could be slashed for 30 years as the baby boomers moved through their peak spending years–even this confluence of unprecedented tailwinds did not spare America from a prolonged recession and banking crisis in the early years of Reaganomics.

Today after 8 years of Fed-suppressed yields and ever-more-lax lending schemes, demand-exhaustion is the order of the day in all big GDP drivers from housing to vehicles to equipment. And at this point, with present levels of debt, even if infrastructure spending is passed, the impact is a negative multiplier effect on growth. Believe it or not. Doesn’t mean we shouldn’t invest in our infrastructure; just means it won’t be the wonder drug to revive economic growth any time soon. Here is Hoisington and Hunt:

“Additional deficit spending for infrastructure also carries a negative multiplier. This is confirmed by recent scholarly research. Let’s say, for the purpose of argument, that the multiplier is a small positive. It will take a long time to develop the preliminary engineering and design work to identify the projects and even to hire the contractors. So even if the multiplier were not negative, the benefit seems to be well into the future.”

The brightest growth sector today is the booming clean energy sector which Trump has foolishly so far said he would move to quash (hopefully that business acumen he has promised us all will cause him to abandon this dumb idea fast). Luckily for the world, the sector is now advanced enough and so efficient and obviously helpful to real families and businesses, that we are past the point where federal dummies can do it much harm. Course they may still waste our tax dollars trying to prop up dinosaurs a while longer.

Bottom line is this: whatever governments come into power during this phase of history, they are likely to over-promise and under-deliver, and the populace looking for quick fixes is likely to run out of patience.

The future is bright so long as we write down and write off bad debts, stop wasting money on asset propping schemes and funnel our collective talents and energy toward things that will work to improve the quality of life on earth for the masses.

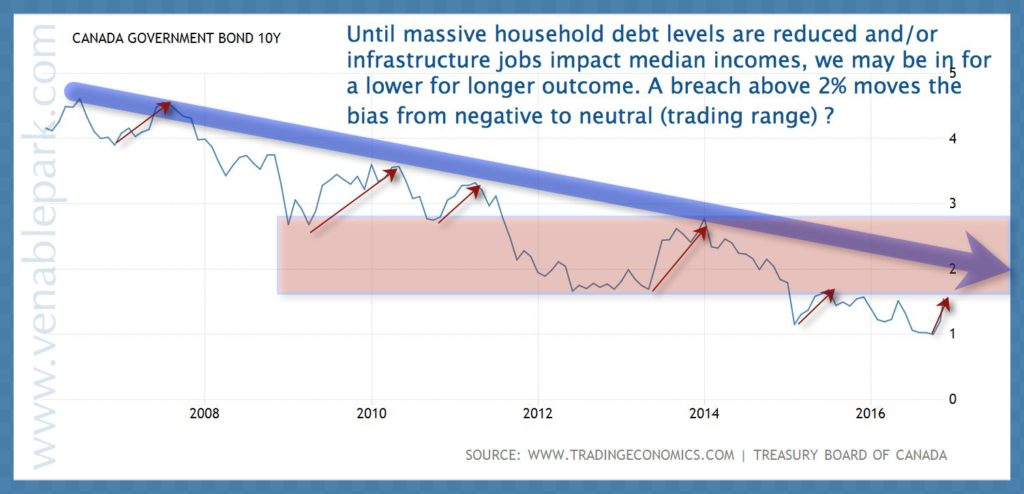

This big picture chart of Canadian 10 year bond yields, gives some perspective on the rise in rates over the past week (small red arrow on right) relative to the long term trend (purple arrow) lower since the US consumer credit bubble burst in 2007.

This chart of the Canadian stock market over the past 3 years, tells a similar tale. The latest rally has taken us back near resistance for the third time (see red circles) and still well below the euphoric peak of May 2008. Best not to lose the forest for the trees here.

Those who care about their capital would be wise to not bank on miracle cures from new leaders and plans to add even more debt and government stimulus; but to settle in for the slower, meaningful work of building savings and retooling the economy away from non-productive goods consumption and self-destructive technologies, toward making the products and services that will enable a strong and sustainable increase in health and productivity. That way lies improved quality of life for all.