I’ve written about why the myth of Warren Buffett can be harmful to real life investors several times over the past decade. See a few articles here. I used to respect his legend, now I can’t, here’s why.

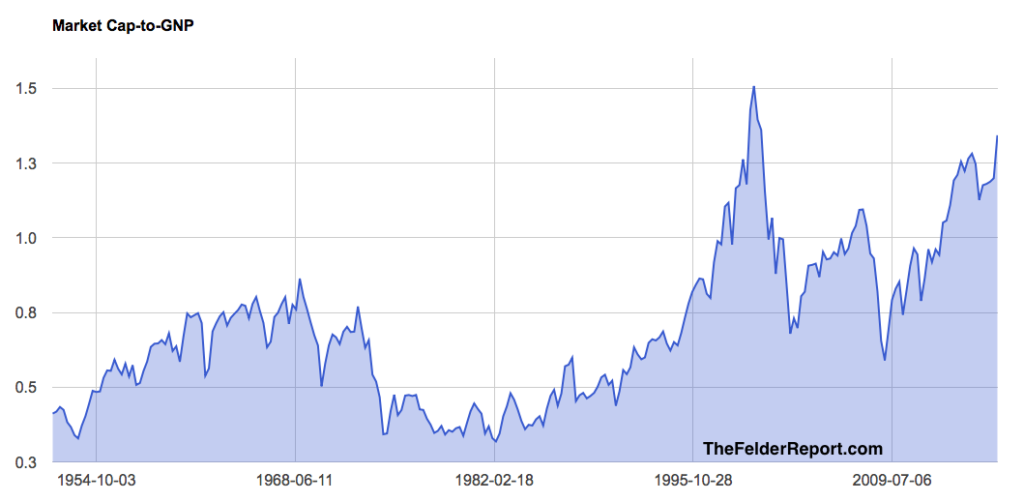

In December 2001, Buffett (then just 71), collaborated on a Fortune magazine article entitled Warren Buffett on the stock market, in which he referenced what he considered the most important investment market valuation gauge: Market cap of US stocks to US Gross National Product. We include the chart below since 1953 updated to the present. And here is Buffett’s observation on this indicator from the Fortune article:

“Below is a chart, starting almost 80 years ago and really quite fundamental in what it says. The chart shows the market value of all publicly traded securities as a percentage of the country’s business–that is, as a percentage of GNP. The ratio has certain limitations in telling you what you need to know. Still, it is probably the best single measure of where valuations stand at any given moment. And as you can see, nearly two years ago the ratio rose to an unprecedented level. That should have been a very strong warning signal.”

In looking at the most recent level on this historically prophetic chart (far right side), one can see that US stocks are once more extremely over-valued, only slightly under the all time historic peak of March 2000 (after which they lost 50-80%). And yet, Mr. Buffett, has not mentioned any concern about valuations and price risk when interviewed over the past couple of years.

In looking at the most recent level on this historically prophetic chart (far right side), one can see that US stocks are once more extremely over-valued, only slightly under the all time historic peak of March 2000 (after which they lost 50-80%). And yet, Mr. Buffett, has not mentioned any concern about valuations and price risk when interviewed over the past couple of years.

Financial-tainment is in the business of reporting bullish comments, wherever possible (keep those financial sponsors happy!), and Mr Buffett is one of their favorites. After all, he’s a billionaire, so he ‘ought a know, right? Except, this is the dark side of the money business. As I explained in Buy and hold Buffett necessarily perpetually bullish:

The problem now of course, is that this market cycle is long in the tooth and valuations are more over-stretched today than they were at the 2007 and even the 2000 peak in most indicators. After both of those manic tops, Berkshire shares plunged with the broader markets giving away 12 years of apparent gains in 15 months. Since Berkshire is an equity fund with too-big-to-move concentrated positions, it now follows a buy and hold approach. Not surprising then that Buffett says he doesn’t sweat about the economy or market moves; he doesn’t worry about market rigging or HFT front-running, he just buys businesses he likes. Nice but, how does any of that help real people with finite life spans and time horizons. After all, 99.999% of the world’s population are not billionaires Warren. For most of us, years spent making back losses are years we simply can’t afford.

Last week Jesse Felder echoed similar disappointment with Mr. Buffett in Why Warren Buffett is so reluctant to call stocks a “bubble”:

“Mr. Buffett doesn’t want to go down in history as they guy who burst the “everything bubble.” He clearly has much more concern for his own legacy. Still, I had greater admiration for the man who saw more value in promoting the truth in finance than protecting his image as a stock market Santa Claus.

The fact is that 8 years from the last cyclical decline, amidst the final throes of a secular bear market, with investment valuations back at nose-bleed levels, stocks and corporate bonds are once more set up for a particularly deep mean reversion cycle. And Buffett’s fund–that took 5 full years to recoup its 2008-09 losses–is once more poised to plunge in lock step with the S&P 500.

Another 50% loss would take Berkshire’s share price all the way back to the same level it was in 2007. Investors would have zero, but heartache and wasted time, to show for their faith and hope after more than a decade.

At 86, still working, and with far more riches than most, Buffett may well not live to see the next recovery that follows the coming bear market. His longevity odds aren’t good. But for those that will be here trying to live off their savings for the next 10 and 30 years, what happens to our capital over the next 1-10 years, will have profound impacts on our life plans and mental health. Lost decades matter a lot in the land of mortals. This is especially true, since at the end of secular bears, it can take many years–even a couple of decades– for prices to recover prior cycle peaks.

It’s not what markets have ‘made’ on QE-mania the past few years that will determine this outcome. It’s what capital we keep through the next correction, that will decide financial fates in our lifetime. For that reason, we must protect our savings from long-always-oracles from Omaha, and everywhere else. That’s reality.

Footnote: A reader reminded me of other reasons to be less impressed with the legend of Buffett’s investment genius: he was a major investor in several of the largest US banks heading into the 2008 crisis (Wells Fargo, Bank of America, American Express and Goldman Sachs). As a result, Berkshire Hathaway directly benefited from the TARP funds and other Fed interventions rolled out to rescue the banks from their well-earned insolvency. Buffett advised the US government in favor of these measures and his ‘hard work’ directly benefited himself and Berkshire, courtesy of the US taxpayer. It also helped his company shares (and reputation) recover their losses over the following 5 years. This and more is explained by author Peter Schweizer in his 2011 book, “Throw Them All Out: How Politicians and Their Friends Get Rich Off Insider Stock Tips, Land Deals, and Cronyism That Would Send the Rest of Us to Prison.”