Realty prices in Ontario, dropped sharply in September. In the Greater Toronto Area (GTA) 1 hour north of the city (where I live), average prices have already come off about 20%+ from last spring. And while the stricter mortgage rules announced for January will doubtless prompt some to try and squeeze into properties before Christmas, market weakness in 2018 is likely to continue. See New mortgage rules expected to heat up Toronto housing before winter chill:

While the industry hoped for, and failed to see, a surge of back-to-school homebuyers, the further tightening of mortgage rules could add some temporary autumn heat. BNN’s Greg Bonnell looks at what the experts are saying about one of Canada’s hottest housing markets. Here is a direct video link.

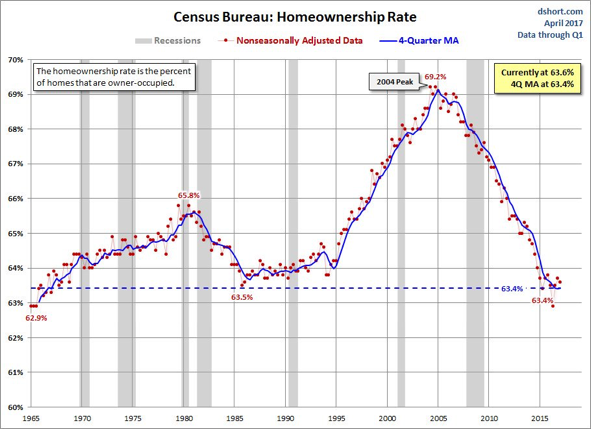

After peaking at 69.2% on subprime mortgage madness into 2005, the US homeownership rate spent 12 years round-tripping back to its 50-year average around 63% as shown here.

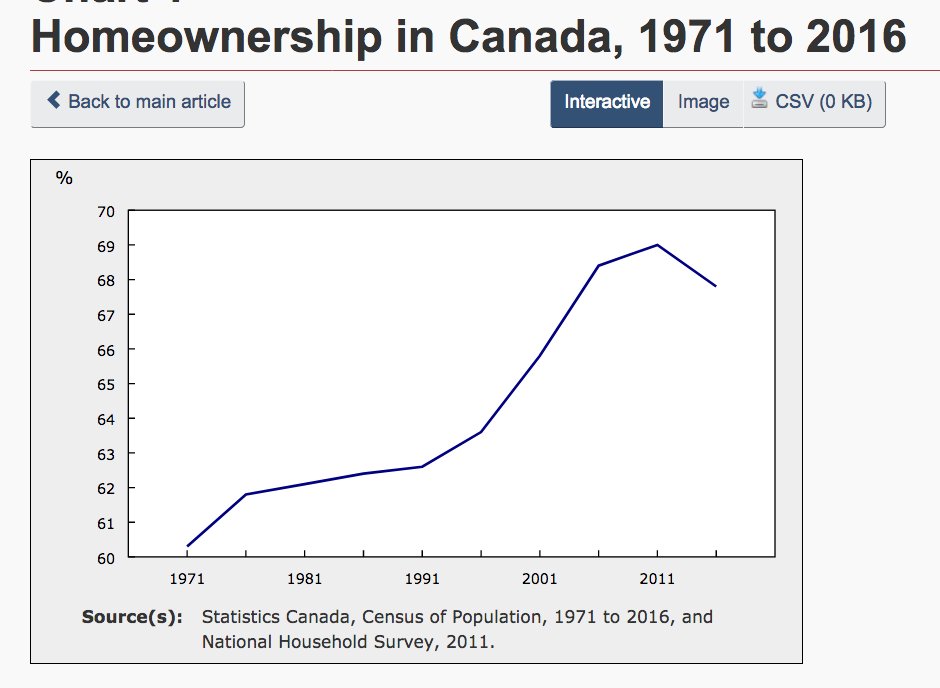

In comparison, after 20 years of steady increases, the Canadian Homeownership rate from the most recent 2016 census was 67.8% —down from the 69% peak in 2011. Since both US and Canadian rates of ownership were driven higher by baby boomers and ever easier credit availability, it is likely that Canada’s rate, like the US, will also mean revert over the next several years, as boomers look to downsize and credit availability and appetite contract.