It is appreciated and rare when financial advisors acknowledge the math of loss and the truth about why compound return expectations routinely disappoint in real life. This article from Lance Roberts is a gem: The buy-and-hold investing approach is part of one of the most ‘hazardous’ stock myths:

Avoiding losses weighs far more heavily in compounding wealth than does chasing returns…investing in markets that are expensive may provide short-term satisfaction but more than likely will severely harm your ability to meet your retirement goals. The reason…this message seems lost on many investment professionals and individuals is because:

- They have never been through a major market reversion

- They have only lived through one (2008) and assume another “financial crisis” cannot happen in our lifetimes.

- They find it easier to passively manage money and blame major drawdowns on the markets rather than commit to the efforts, rigorous analysis, and mental fortitude to go against the crowd. These are all important traits needed to manage an active investment strategy.

Even if we suspend reality and fantasize that an investor–does not pay any fees or taxes, nor make withdrawals at any time, nor amass the bulk of their life saving late in life, nor add lump sums to expensive securities near cycle highs nor sell after cyclical drops–even if we assume all of this–and that a person added the same amount of savings to buy stocks every year, never more never less, and automatically reinvested every single dividend 100% back into more shares–that theoretical person still has spent 10+ years trying to grow their capital back to even after each manic secular peak in equity and corporate debt valuations since 1920.

And while this fantastical best-case-person is spending 10-15 years growing back losses to accomplish zero net gains, there is a high probability that their emotional, family and physical life have been negatively impacted, and too-late-to-fix financial plans substantially undone.

Consider that from 2000 through 2013, the S&P 500 Index, including dividends and inflation, delivered a zero rate of return. And from 2000 through 2017, it returned a scant 0.30% more than risk-free Treasury bonds (5.4% annualized for stocks versus 5.1% annualized for bonds). Further, to reach that return it required the expansion of valuation multiples to extreme and risky levels. Equity investors have endured two 50% draw downs, and over a decade of no returns, to achieve an 18-year, 30 basis point annualized pickup over bonds. In recent years that entailed holding equities that were well above long-term averages and presented a poor risk/return framework.

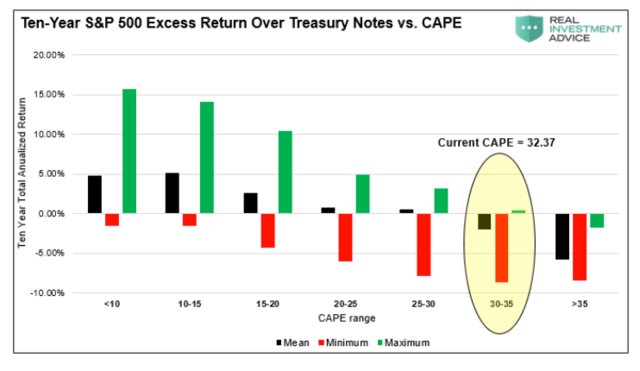

Today we are facing another decade+ of zero real return prospects for equity holders from the current extreme valuation (CAPE) of 32 on the S&P 500. The chart below shows the annualized performance of 10-year equity returns versus 10-year U.S. Treasury notes based on over 100 years of history.

Holding equity risk at these levels is not savvy, it’s financially suicidal. Standing clear of toppling trees and then going in to pick up fire wood after the fall, is a much more rational plan. But that takes personal discipline and patience on the part of clients, as well as the fortitude of advisors to put their clients’ best interests ahead of the industry’s short-focused asset ‘growth’ targets.