ABC discusses the problem faced by many interest only loan holders as tighter lending standards bite, forcing some to higher payment P&I loans. Here is a direct video link.

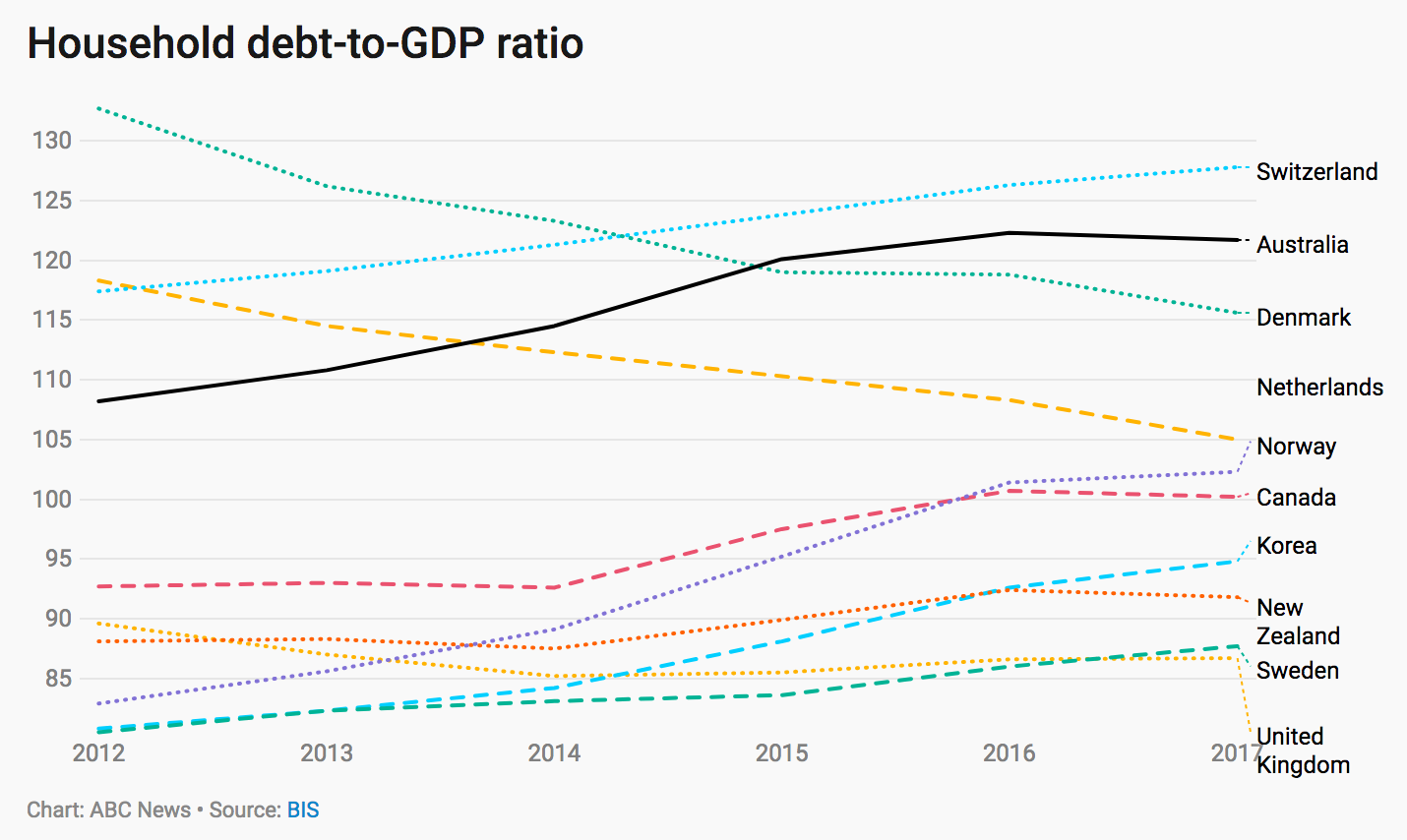

Meanwhile Australia has the second most indebted households–as a percentage of national GDP– in the world (see chart below). As in Canada, and most other developed countries today, massive indebtedness will increasingly weigh on aging populations with falling productivity and cash flows. Also see: Australia pipped by Switzerland for debt world title:

As things stand, it would take a year and 79 days of Australia’s total economic output to pay off what we owe — and that doesn’t include the interest we’re accruing. That’s more than twice as much household debt as Greeks have.

Only the Swiss are more indebted and, while we may not beat them on the football field, we’ve now got the Danes licked for household debt.

With so much debt, Australians also have high repayments, averaging 15.5 per cent of incomes, second only to the Dutch at 16.6.