Australian politicians like to boast that the country has not experienced a period of negative economic growth since 1992–an unprecedented 26 years.

Amazing and yet, trying to avoid recessions by continuing to expand credit, and never allowing necessary paydown periods, is like trying to avoid pumping out your septic tank. Eventually the dung back-up is destined to be overwhelming.

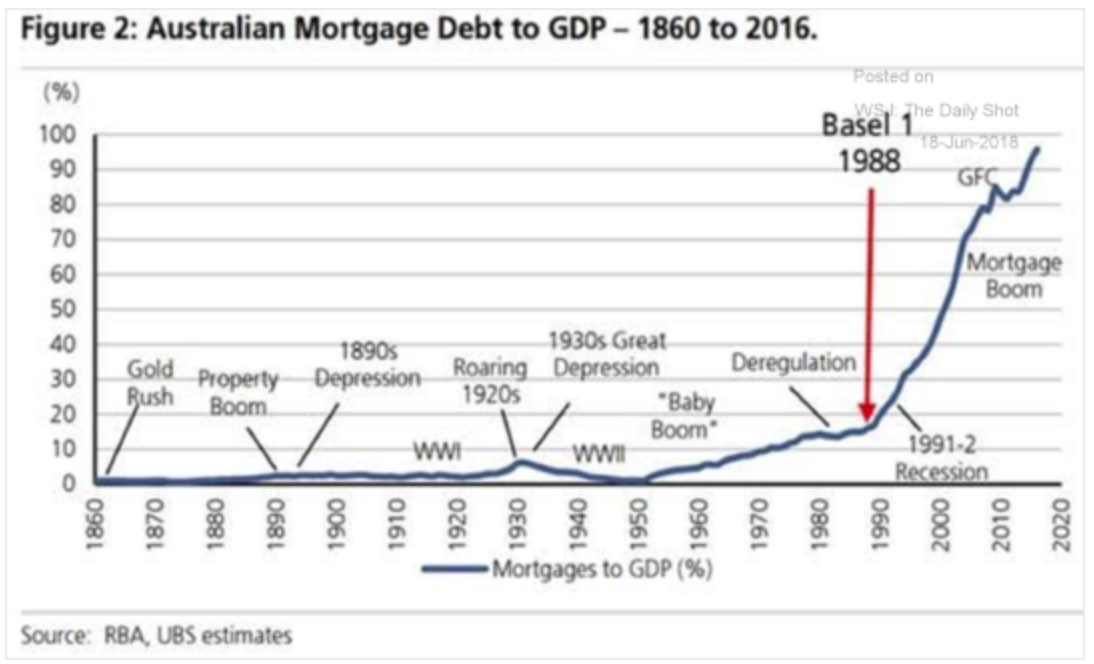

This chart of Australian mortgage debt to GDP since 1860 tells the tale of how Australia has managed to perpetually increase domestic consumption the past 2 decades, why they now now have some of the least affordable housing on the planet, and why the paydown period coming is likely to be extra long and challenging. Speculator wipe-outs, debt write-offs, lower property prices and banking strife, are all part of the pump out needed to stabilize income and balance sheets from this historic episode of pretend and extend.