China’s Shanghai stock index closed last week down 4% and nearly 19% since January 26 even as the government continues with a barrage of ongoing confidence suasion efforts, see Beijing paddles as bear market threatens:

The so-called “national team,” an assortment of government-backed investment funds that often acts to stabilize the market, still owns nearly half a trillion dollars worth of stocks, or around 6% of the total, according to Wind Information. Regulators have also been meddling in more subtle ways, like ordering brokerage firms or investors not to engage in heavy selling.

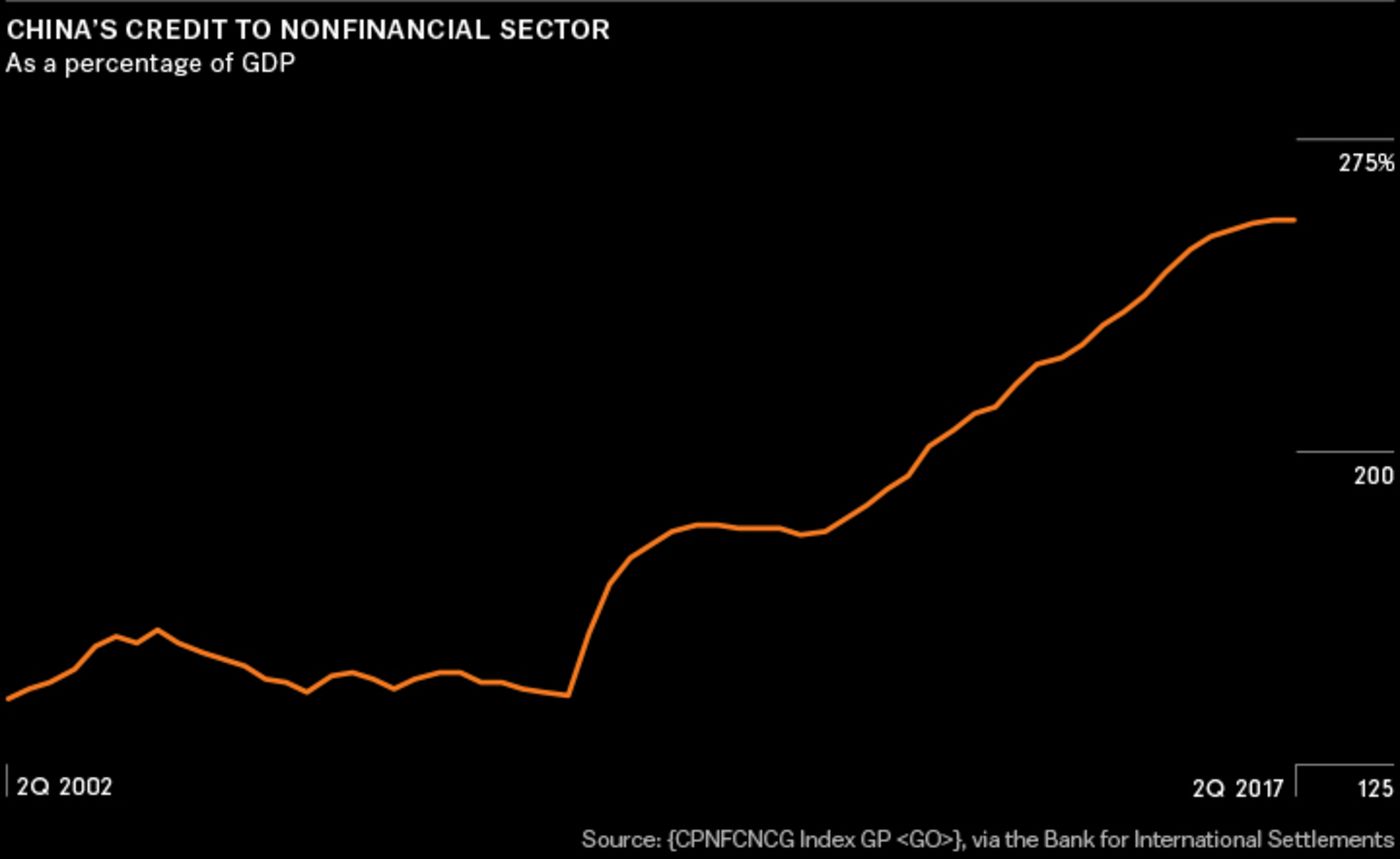

Eleven straight years of credit pumping and market rigging have led to massive debt and asset bubbles now hanging over  China and the global economy. As shown here, China’s non-financial debt as a percentage of its GDP, at some 260%, has doubled since 2008. See Sizing up China’s debt bubble.

China and the global economy. As shown here, China’s non-financial debt as a percentage of its GDP, at some 260%, has doubled since 2008. See Sizing up China’s debt bubble.

Meanwhile, as shown in my partner Cory Venable’s chart below of the Shanghai stock index over the last 20 years, at 2889 today, the Shanghai index is back at the level it was in December 2014 …and February 2007 before that.

This is the natural course of mean reversion, financial engineering leads to temporary price inflation and then collapse with years and decades thereafter, trying to grow back to even. More downside is likely from here with a retest of the 2009 and 2013 lows (red circles) probable as the global economy recesses once more.

The fundamental challenges of crushing debt and soaring defaults amid an aging population, slowing global demand and environmental unsustainability remain yet to be addressed.

‘Easy’ money policies start quick and easy but end up long and hard. Monetary magicians can keep trying tricks but they can’t avoid the cleansing necessity of bear markets nor conjure higher productivity. The latter takes hard work: reform, innovation, higher efficiency, less debt, more savings and time.