Each business cycle, central banks optimistically hike rates with the stated goal of slowing the economy enough to prevent it from overheating and not so much as to trigger a recession. They have failed in this goal 12 of the last 13 tightening cycles, with a recession and stock market swoon following all but one in the mid-1990’s.

After the last two recessions in 2001 and 2008, the US Fed left rates successively lower for longer which enabled debt and financial leverage to balloon to record levels. This has made the economy and financial system less stable and more vulnerable to steeper correction phases than historically average. We are now facing the third ‘correction’ phase of the past 20 years, and it is set up to be the most extreme yet, just as the largest population of asset owners are tumbling into the over age 65 category in record numbers. Baby boomers were gifted with fortuitous timing through most of their lives; this next phase will be a harsh payback period for many.

With the global economy already slowing, and stock and corporate debt markets already swooning, it is likely that the US Fed will once more signal a ‘surprise’ pause in its rate-hiking plans in 2019. In Canada, with slumping home prices, stocks and oil already spreading financial distress, it is likely that the Bank of Canada will pause in its tightening cycle even sooner than the US Fed. But this will be no magic fix.

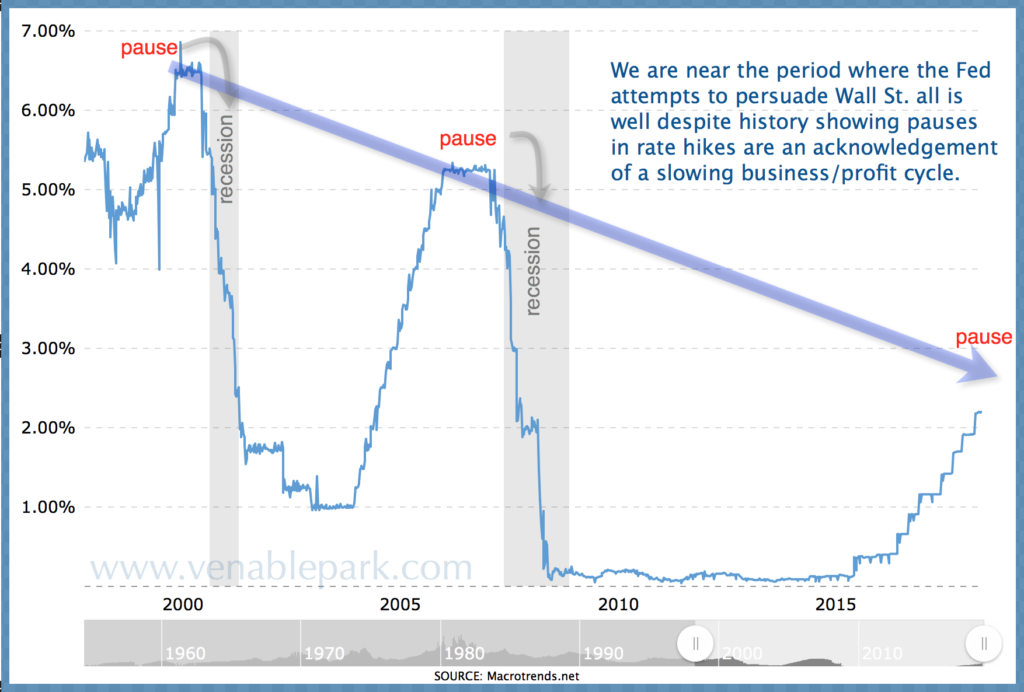

As shown in the below chart of Fed tightening and easing cycles since 1998 from my partner Cory Venable, by the time central banks pause, a recession is already likely to be imminent and the stock market already in the throes of a deep bear market. By the time policymakers move to ease once more, financial damage will already be far and wide.

We should make no mistake, the fault is not in the hiking cycle. The fault is in the extended periods of too-easy money and imprudent financial management that precede the fall. In that, a doozy of a cleansing period is well and truly due.

As shown here, no one should be surprised to see the Canadian stock market potentially retest the 9000 area–some 40% below current levels–as this mean reversion cycle completes.

For the S&P 500 shown below, secular and cyclical forces suggest that a retest of the 2000 and 2007 cycles highs in the 1600 area–also 40% below current levels–would be a relatively mild give back following the extraordinary monetary and fiscal stimulants of the past decade.

Present holders should consider how such declines would impact their investment plan, particularly since it is likely to be several years thereafter before prices can return near present levels. Heads up.