We have been noting all year, that central banks were unlikely to hike their policy rates as hoped because economic weakness in the highly indebted global economy would cause them to pause, and then return to another round of accommodative experiments.

As I wrote here last week in Nearing the Pause that Won’t Refresh? every business cycle central banks optimistically hike rates with the stated goal of slowing the economy enough to prevent it from overheating and not so much as to trigger a recession.

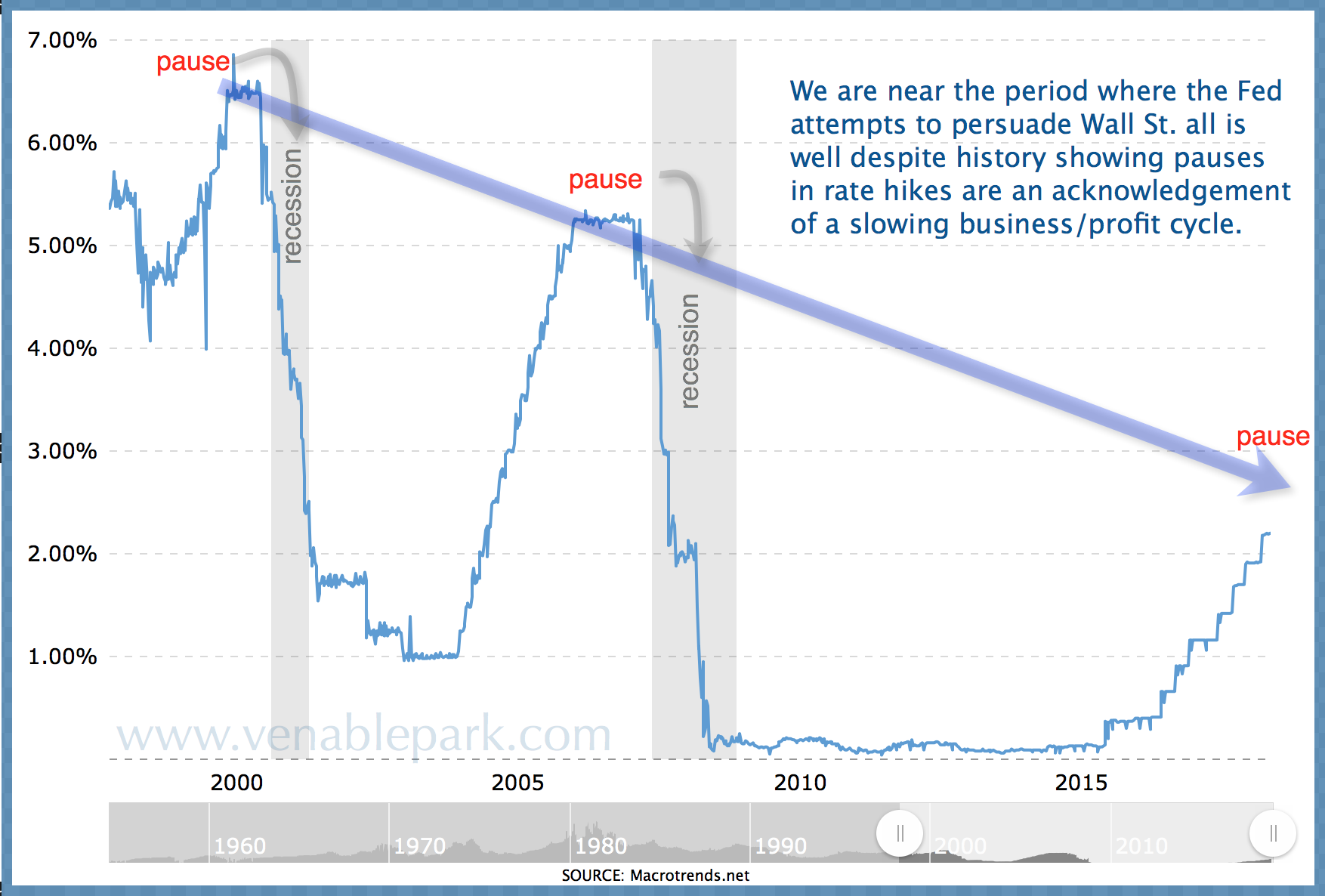

And even though they have failed in this goal 12 of the last 13 tightening cycles, with a recession and bear market following all but one in the mid-1990s, hope springs eternal. This chart shows the rate-hiking pause that preceded the last two recessions in 2001 and 2008 (grey bars).

It is typical for stocks to respond to pause news with initial jubilation, even while government treasuries are bid, and oil makes a 2018 low today. Only the latter two are admitting the vector of growth here. In a co-dependent dance, the more stocks rally at this point, the more likely the Fed will see room to hike further and therein lies the crimp of debt burdens amid falling cash flows.

After the initial surge of exuberance comes a revelation that central banks are eyeing a pause because profit margins are shrinking and the economy and market cycle have already rolled over. If history holds, next comes a reality phase, when the cash crunch intensifies among highly levered participants, and asset liquidation resumes with full vigour.